The Everlasting Option

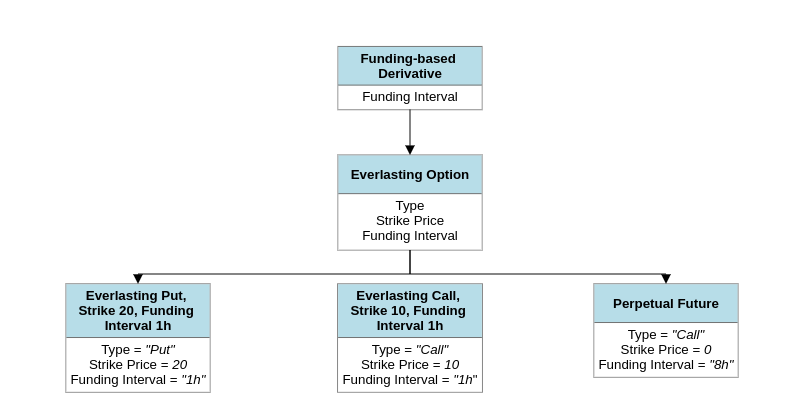

The Everlasting Option is a funding-based derivative that can express an arbitrary number of payoff functions, including the one used by the Perpetual Future. This document provides a high-level overview of the Everlasting Option.

Funding-Based Derivatives

Funding-based derivatives are financial derivatives that include a Funding component. They originated in the late 1980’s, and are currently dominating the cryptocurrency derivatives markets.

Most funding-based derivatives are perpetual.

The Everlasting Option

The Everlasting Option is an example of a funding-based derivative. It has three primary properties:

- Type (Call or Put)

- Strike Price

- Funding Interval

By varying these properties, it is possible for the Everlasting Option to express an arbitrary number of payoff functions.

The Perpetual Future

The simplest (and most popular) instance of the Everlasting Option looks like this:

Type: Call

Strike Price: 0

Funding Interval: 8 hours

This particular instance of the Everlasting Option is most commonly known as the Perpetual Future.

Additional Properties

Index Price

The Index Price represents the intrinsic value of an Everlasting Option.

Fair Price

The Fair Price represents the generally accepted market value of an Everlasting Option.

It is calculated directly from order book data.

A simplified formula for the Fair Price looks like this:

Fair Price = Best Bid + (Best Ask — Best Bid) / 2,

where Best Bid is the bid (X dollars deep in the order book), and Best Ask is the ask (X dollars deep in the order book).

Mark Price

The Mark Price represents the generally accepted market value of an Everlasting Option, throughout the last X time periods. It is calculated directly from the Fair Price.

A simplified formula for the Mark Price looks like this:

Mark Price = EMA30(Fair Price)

where EMA30 is the 30-period exponential moving average and each period is 1 second.

Calculation of the Mark Price requires regular sampling of the Fair Price. In the above example, the Fair Price would need to be sampled once every second.

Premium

The premium of an Everlasting Option is defined as the difference between the market value of the option throughout the last X time periods (Mark Price) and the intrinsic value of the option (Index Price).

Premium = Mark Price — Index Price

Funding Rate

The Funding Rate of an Everlasting Option is determined by the value of its premium throughout the last X time periods. A simplified formula for the Funding Rate could look like this:

Funding Rate = EMA60(Premium/Index Price),

where EMA60 is the 60-period exponential moving average, and each period is 1 minute.

Calculation of the Funding Rate requires periodic sampling of the premium. In the above example, the premium would need to be sampled once every minute.

Funding Rate Constraints

In practice, the Funding Rate is often subject to constraints:

Funding Rate = Min(0.015, Funding Rate)

The Funding Rate is typically also rounded to a multiple of 0.0001.

Funding

An Everlasting Option is subject to Funding. Funding is a periodic exchange of money between longs and shorts. The amount exchanged (Funding Payment) is determined by the Funding Rate:

Funding Payment = Funding Rate * Position Size

If the Funding Rate is positive, longs pay shorts.

Otherwise, shorts pay longs.

Funding takes place at the end of each Funding Period. The length of a Funding Period is determined by the Funding Interval.

The purpose of Funding is to minimize the premium of the Everlasting Option. It does so by incentivizing being short (when the premium is positive), and by incentivizing being long (when the premium is negative).

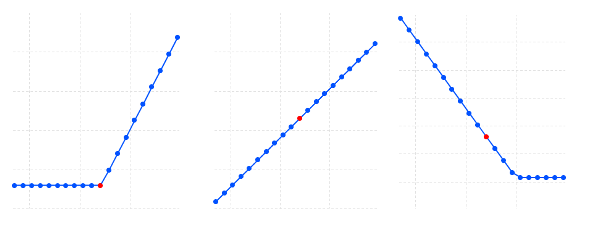

Pricing

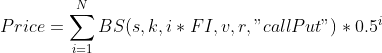

To price an Everlasting Option, split the option into N European-style Options.

Each European-style Option should have the same Strike Price and Type as the original Everlasting Option.

Assign a unique Weight and Expiration to each European-style Option, based on the following pattern:

European-style Option #1: Expiration = 1 * Funding Interval, Weight = 0.5¹

European-style Option #2: Expiration = 2* Funding Interval, Weight = 0.5²

…

European-style Option #N: Expiration = N* Funding Interval, Weight = 0.5n

You can choose N=10.

Next, price each European-style Option using your preferred pricing model (Black & Scholes, Binomial, other). You will now have N different prices.

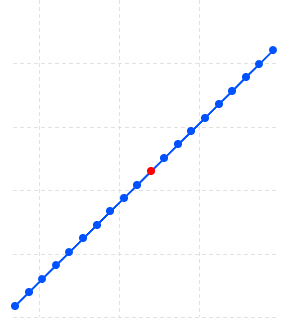

Finally, calculate the weighted sum of your N prices (using the weights from above). This will be the price of the original Everlasting Option.

Example

Consider the Everlasting Call Option with Strike Price 0 and Funding Interval 8h (Perpetual Future).

We can price this option using the method above.

First, divide the option into 10 European-style Options:

European-style Option #1: Type = Call, Strike Price = 0, Expiration = 8h, Weight = 0.5¹

European-style Option #2: Type = Call, Strike Price = 0, Expiration = 16h, Weight = 0.5²

…

European-style Option #10: Type = Call, Strike Price = 0, Expiration = 80h, Weight = 0.5¹⁰

Next, calculate the price of each European-style Option (using Black & Scholes).

Finally, sum the values together, applying the weights from above.

You should arrive at a value that closely resembles the spot price of the Everlasting Option’s underlying asset.

Greeks

To calculate the greeks (delta, gamma, theta, vega) of an Everlasting Option, apply the same method as above, but solve for delta/gamma/theta/vega instead of price.

Approximate Pricing

Sometimes, it may be desirable to quickly calculate the approximate price of an Everlasting Option.

To do so, calculate the price of an equivalent European-style Option with:

Expiration = Funding Interval * 2.

This will give you a ballpark estimate of the Everlasting Option’s value.

You can also use this heuristic to derive the approximate greeks of an Everlasting Option.

Funding Interval

As we saw above, the Funding Interval of an Everlasting Option is a proxy for its expiration.

This proxy is used when pricing the option, and for calculating the greeks of the option.

An Everlasting Option with a Funding Interval of 1 hour is (very roughly) priced like a 0DTE European-style Option, while an Everlasting Option with a Funding Interval of 1 week is (very roughly) priced like a 14DTE European-style Option.

Strike Price

An Everlasting Option can have either a Fixed Strike Price, or a Floating Strike Price.

A Fixed Strike Price Everlasting Option is easy to price, but not very flexible. Fixed Strike Everlasting Options Markets suffer from significant liquidity fragmentation, and require a Strike Introduction Policy and Strike Termination Policy to be successful.

A Floating Strike Price Everlasting Option is the opposite. It is hard to price, but very flexible. Floating Strike Everlasting Options Markets require only a few contracts to be successful. No Strike Introduction Policy or Strike Termination Policy is required.

From a liquidity perspective, the Floating Strike Everlasting Option is superior.

From a pricing perspective, the Fixed Strike Everlasting Option is superior.

In order to be successful, Fixed Strike Everlasting Options Markets typically require a Strike Introduction Policy and a Strike Termination Policy. At the end of each time period, a number of new Strike Prices are introduced, and a number of existing Strike Prices are terminated. Having such a policy violates the perpetual nature of the Everlasting Option, and is why designers of Everlasting Options Markets typically prefer Floating Strike Prices.

The Future of the Everlasting Option

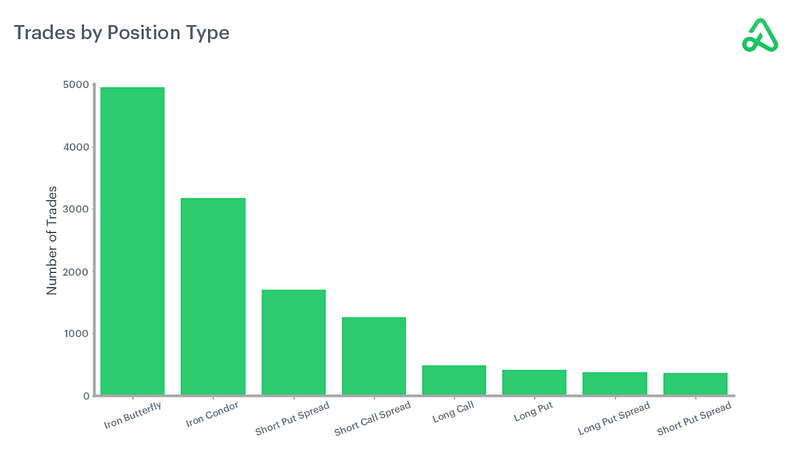

The Everlasting Option has already seen significant adoption within the cryptocurrency niche. However, this adoption has been limited to a specific instance of the Everlasting Option (the Perpetual Future).

In hindsight, it was obvious that the Perpetual Future would be adopted first. After all, it is the simplest version of the Everlasting Option. The price of the Perpetual Future closely resembles the spot price of its underlying asset, making it easy for traders to understand it.

With the Perpetual Future taking up more than 93% of cryptocurrency derivatives volume, we believe that it is now time to explore other instances of the Everlasting Option. Particularly, we see a need for instances of the Everlasting Option that can offer positive convexity. The linear P/L curve of the Perpetual Future is easy to understand, but not powerful enough to satisfy the needs of the next generation of cryptocurrency traders.

Everstrike

Everstrike offers Floating Strike Everlasting Options for 8 different cryptocurrency assets.

The options have a Funding Interval of 1 hour.

Everstrike chose this particular Funding Interval to achieve a greeks profile similar to that of 0DTE European-style Options. 0DTE European-style Options dominate the global options markets, making up more than 40% of the overall trading volume. Having access to perpetual options is particularly important for traders of 0DTE options, as the costs associated with rolling on a daily basis can be significant.

The Everlasting Options on Everstrike have Floating Strike Prices (pinned around the 100-hour EMA of the underlier). No Strike Introduction Policy or Strike Termination Policy is required. By combining a long EMA (100 hours) with a short Funding Interval (1 hour), the options remain relatively easy to price.