Beginner's Guide To Vibetrading

Vibetrading has been making headlines on Forbes recently. It represents the biggest paradigm shift in trading since the invention of electronic trading in 1971.

If you're not sure what it is, don't worry. This guide will teach you the basics.

What is vibetrading?

Vibetrading is a revolutionary new way to trade, where you submit AI prompts instead of orders.

It can be considered the trading equivalent of vibecoding.

Vibetrading is:

- No-code AI-assisted trading

- A way to automate existing trading strategies using AI

- A beginner-friendly alternative to algorithmic trading / quant trading

- A way of using domain knowledge about trading to make money

Vibetrading is NOT:

- A way to get rich quickly without knowing anything about trading

Vibetrading step 1 - the prompt

Any vibetrading adventure starts out with a prompt.

The prompt defines what your AI should and shouldn't do.

Here are some tips for writing a good prompt:

- Be as specific as possible. Include entry and exit conditions. Include a maximum position size.

- Consider edge cases. Some models will treat an instruction to "sell at a high CCI" to not only sell at a CCI of 300 but also at a CCI of -300. This happens because the model considers -300 "high" in absolute terms. The solution is to be extremely specific, carefully consider ways that the instruction could be misinterpreted, and to limit the creativity (temperature) of the model.

- Verify that your AI can access the data that you are referencing inside your prompt. If you reference data that your AI does not have knowledge of, and cannot access, your AI will not be able to make informed decisions on your behalf. The documentation for your vibetrading platform should include a list of data references that you can utilize inside your prompt. Typically this includes technical data, fundamental data and statistical data. But not all types of data are supported, so be careful.

- Use multiple sections if needed. Typically prompts have a character limit (could be anywhere between 1,000 and 10,000 characters, depending on the platform), but the character limit is usually large enough to accommodate dozens of paragraphs and sections.

- Choose your language carefully. While prompts can be written in any natural language, most models perform best with a major language like English. Smaller languages can be problematic for some models.

- Realize what your AI can and cannot do. On most vibetrading platforms, models can follow buy and sell instructions based on numerical data, but they cannot visually analyze charts, like a human trader would do. Be careful with instructions that require visual analysis, such as instructions that reference trend lines.

Vibetrading step 2 - choosing parameters

Vibetrading is only as successful as the model you use, and the parameters you use to tune the model.

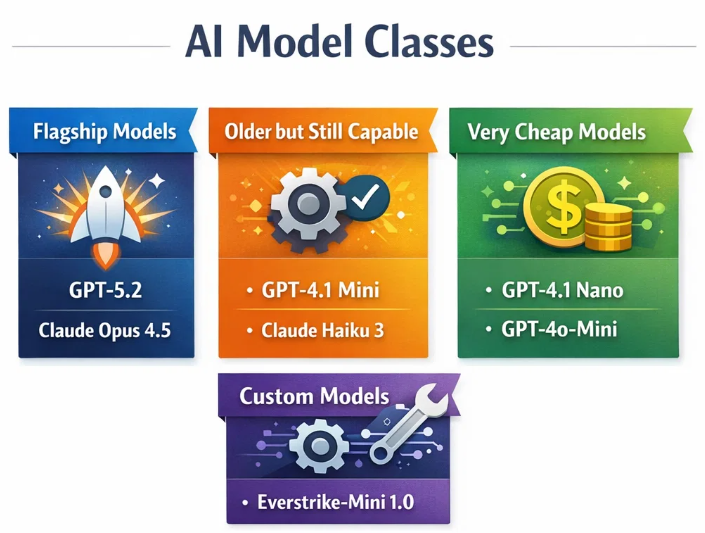

Popular models for vibetrading include:

- Flagship models (GPT 5.2, Claude Opus 4.5, Gemini 3 Pro) - these are expensive, and are typically used for low-frequency high-impact prompts

- Older, cheaper models (GPT Mini 4.1, Claude Haiku 3) - cheaper than flagship models but still capable - good for most strategies

- Very cheap models (GPT Nano 4.1, GPT 4o-mini) - typically used for mid-to-high-frequency trading (tens of thousands of model queries per day)

- Custom models (Everstrike-Mini 1.0) - these models are specifically designed for vibetrading and usually perform better than generic models

Once you have selected your model, you can tune any of the following parameters:

- Minimum confidence - how confident the model should be prior to committing to a trading decision

- Temperature - creativity of the model

- Top p - creativity of the model

It is recommend to start out with a temperature of zero and a very high minimum confidence threshold (90% or greater). This makes the AI behave very deterministically and greatly reduces the rate at which it trades.

Once you become more confident in your AI, you can gradually increase its temperature (enabling it to effectively become a discretionary trader and make decisions independent of its strategy), and lower its minimum confidence threshold (allowing it to trade more often).

Vibetrading step 3 - managing risk

To manage your risk when vibetrading you can do any of the following:

- Use a fixed order quantity (prevents the AI from controlling the trade size)

- Include a maximum position size instruction inside your prompt (guides the AI to stay within position limits)

- Use a high minimum confidence threshold (greatly reduces the hallucination rate of the AI)

- Limit the markets that the AI can trade

- Define risk parameters and no-trade conditions thoroughly inside your prompt

- Add a kill switch to your prompt (switches off trading if a big loss is accumulated)

Vibetrading step 4 - monitoring your agent

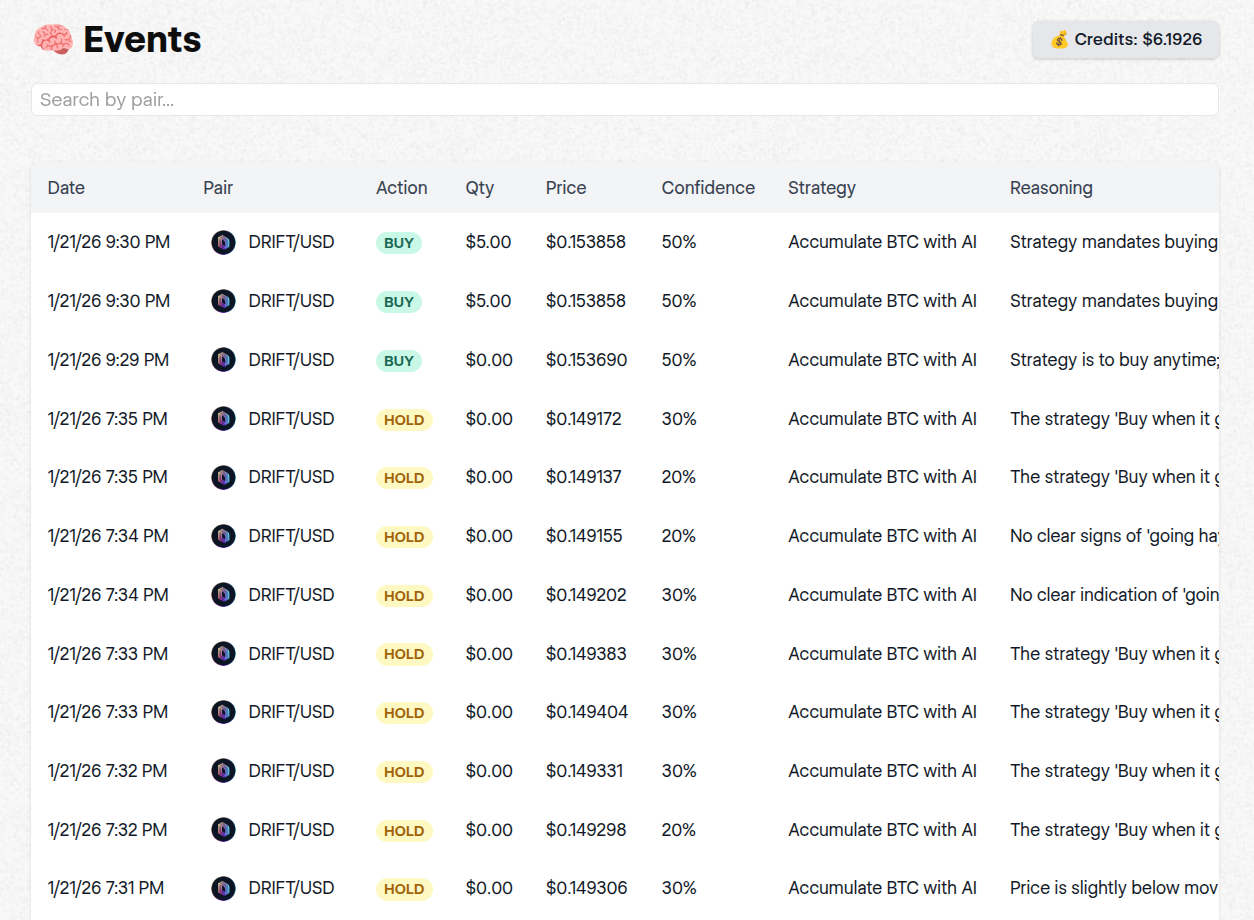

Your AI may make 100-10,000 decisions per day. You do not need to examine all of them. However, you do usually benefit from having a general idea of what your AI is doing, and why it is doing it. Examining some of the decisions made by your AI and the reasoning for them can help you refine and improve your prompt.

To help you understand your AI agent, you can examine:

- Reasoning (what led the agent to its decision)

- Confidence (how confident the agent was in its decision)

Understanding the reasoning that your agent employs is especially useful for high-impact decisions that lead to trading. Most vibetrading platforms allow you to search through the decisions made by your agent, sort them by confidence and impact, and examine the reasoning behind each. This is crucial for refining your prompt over time and improving the performance of your agent.

Vibetrading step 5 - managing costs

Vibetrading can be an easy way to burn through a lot of money in model expenses if you don't know what you are doing.

Here are some ways to save money when vibetrading:

- Choose the right model (older and smaller models like GPT 4.1 mini can be adequate for many strategies and are much cheaper than flagship models)

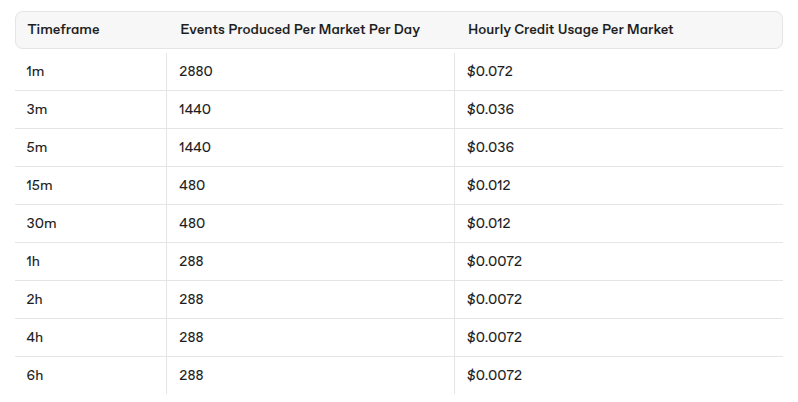

- Choose the right evaluation frequency (unless you are doing high frequency trading, your strategy should not query the AI every second - choosing the right evaluation frequency for your AI can help reduce the amount of model tokens consumed)

- Restrict the context window of your AI (restricting the amount of markets that your AI trades, and the data that it processes, can lower your input token consumption significantly, leading to cost savings)

A sensible default is to start with GPT 4.1 mini, a single market and an evaluation frequency of 5 minute. On a vibetrading exchange like Everstrike, this will result in a daily cost of $0.864.

As you become more confident in your AI, you can gradually increase the amount of markets that it trades and increase its evaluation frequency.

Vibetrading step 6 - refining your prompt

Just as with vibecoding, vibetrading is built on continuous iteration and refinement. The process only stops once you have achieved your goals. Your prompts are likely to evolve significantly over time.

After vibetrading for a year or two (or even just a few months), you may look back at some of your old prompts and cringe at how bad they were. This is normal. Vibetrading is a creative profession. Creative professions require time and dedication. Just as you don't become a good writer in 1 day, you also won't become a good vibetrader in 1 day. Keep iterating and refining till you reach your goals.