From Hand-Signed Forms To LLM's: The Evolution Of Order Submission

The order is one of the oldest trading primitives in existence. First introduced in 1602 on the Amsterdam Stock Exchange, the order has defined trading for the past four centuries.

Placing orders to buy shares in a company was not always easy. In the 17th century, investors on the Amsterdam Stock Exchange had to visit the stock exchange in person and fill out multiple paper forms by hand in order to make a purchase.

The forms would state something like "Buy 10 shares of VOC at 110 guilders or less". Once the forms had been recorded by bookkeepers, stock exchange employees would try to find a counterparty. This could take days or months.

The introduction of trading floors in the 19th century simplified the process a bit, as orders could now be submitted verbally. A client would state his intention to buy or sell to his broker, and the broker would shout across the floor, trying to find someone who was willing to take the other side of the trade.

Later, telegraphs and telephones allowed investors to place orders remotely, and in the 1970's, electronic trading systems (NASDAQ) emerged, matching orders automatically using computer software.

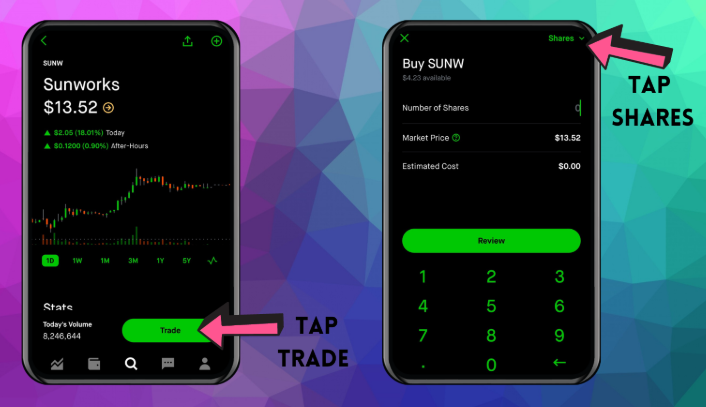

The internet further simplified things, as investors could now place orders directly through a web interface. The invention of trading apps like Robinhood in the 2010's made it as easy as clicking a button on a phone.

The Invention of Prompt Trading

The AI boom of 2024 and 2025 facilitated an entirely new way of submitting orders.

Instead of submitting orders manually, orders could now be generated and submitted by large language models (LLM's).

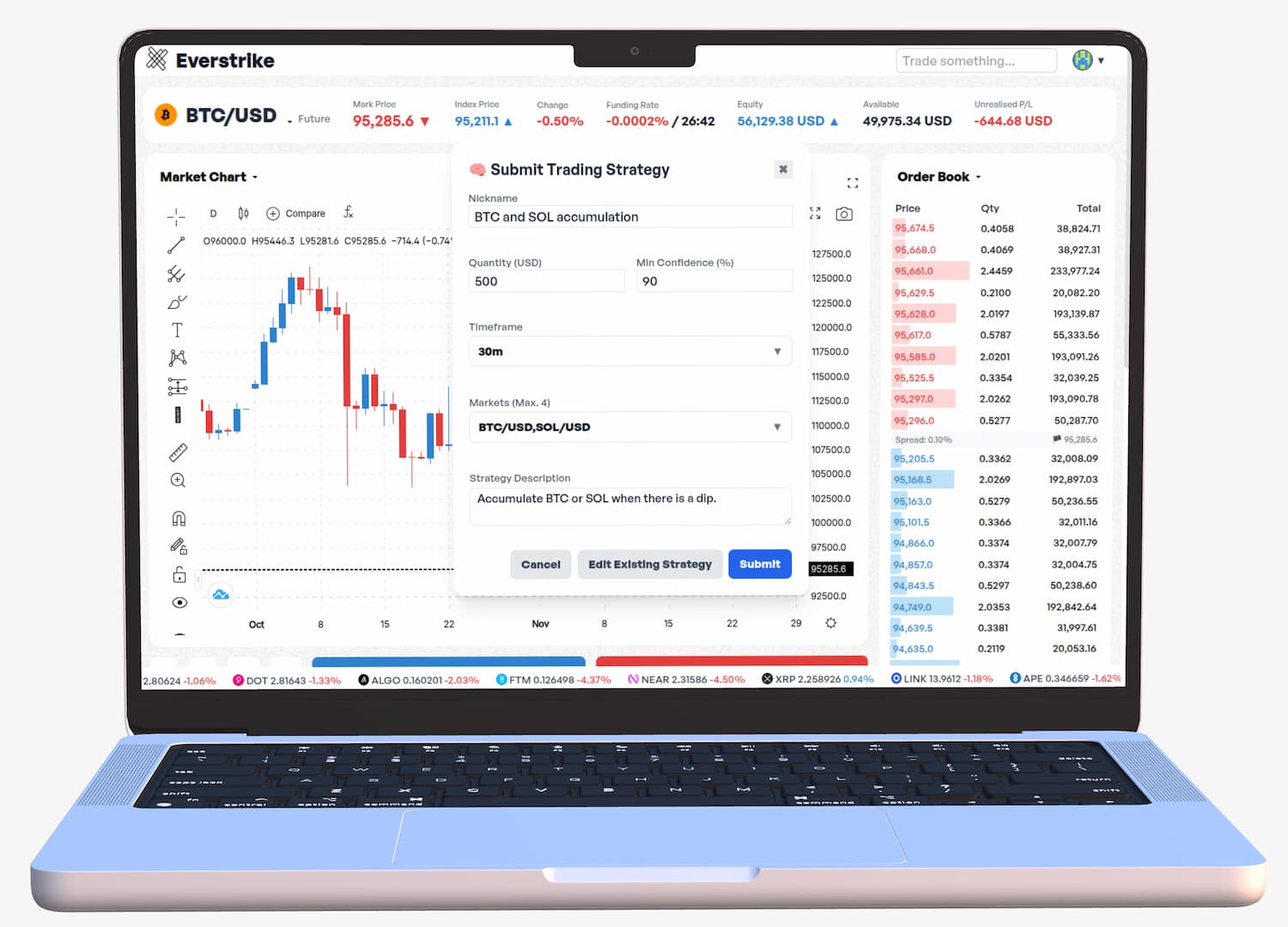

LLM's could understand very abstract text and voice descriptions ("buy when there is a dip or when Trump tweets negatively about tariffs") and turn them into marketable orders.

Investors no longer had to click any buttons, but could now simply explain their investment strategy to an LLM, which would then automatically generate and submit orders on behalf of them.

The LLM would work around the clock, like a financial analyst on steroids, crunching through market data and submitting orders based on client requirements.

Prompt trading (trading by submitting prompts to an LLM instead of by clicking buttons) became a reality.

Order Submission In 5 Years From Now

While most investors still submit orders manually today, the landscape is rapidly changing.

Vibetrading platforms and prompt trading platforms are popping up everywhere, allowing investors to put away their phones and automate their entire trading and investment process.

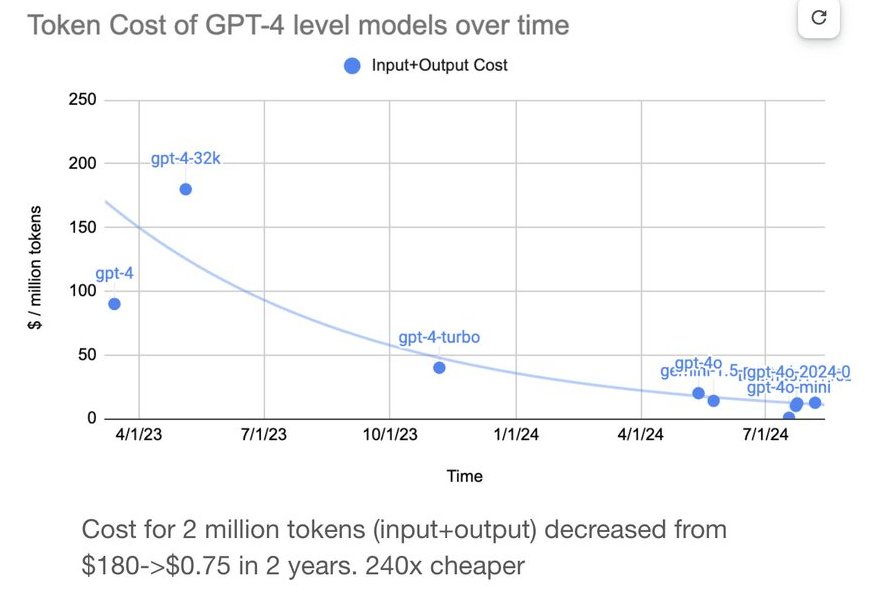

Powered by an increasingly cheaper set of LLM models (LLM inference costs have decreased by 240x since 2023), these platforms are becoming increasingly more viable, and are rapidly gaining market share.

Experts estimate that in 2030 more than 50% of all orders in the retail trading and investment space will be generated and submitted by LLM's.

Many are still skeptical about the application of LLM's in trading, as LLM's are non-deterministic language models and have no built-in concept of arithmetics and determinism.

However, LLM's are excellent at parsing human instructions and turning such instructions into trading strategies. By employing concepts such as minimum confidence, LLM's can become very deterministic, and can trivially accomplish simple tasks such as buying at a specific price. They are also getting increasingly good at accomplishing more complex tasks, such as buying according to a specific strategy, or trading a non-trivial mean reversion or breakout strategy that has been explained to them in detail.

LLM-assisted order submission can be thought of as a superset of manual order submission. The LLM can trivially accomplish what a manual order can accomplish (buy or sell at a specific price), but can also accomplish much more complex goals, such as buying on a specific data condition (i.e. a tweet by a politician or a divergence on a technical indicator). LLM-assisted order submission comes with additional costs (LLM inference is not free), but is also much more powerful and flexible relative to its manual counterpart. If stop limit orders and stop market orders are the powerful uncles of regular limit orders, LLM-assisted orders are their godfather.

The Automation Of Retail Trading

HFT (high frequency trading) accounts for more than 98.5% of all orders today. HFT is entirely automated and has been so for the past 2 decades.

However, retail orders are still primarily submitted manually, as individual investors and traders do not yet have the means to automate their strategies. Experts estimate that less than 25% of all retail orders are currently algorithmic.

This is changing, however, as prompt trading gains adoption, and LLM's become cheaper and more powerful.

Retail order flow has traditionally been known as "dumb money" among HFT's, as it is generally uninformed, non-automated and non-optimized. HFT's have gone as far as paying for retail order flow (funding entire business models such as the one previously employed by zero commission brokerage Robinhood).

With the rise of prompt trading HFT's will need to adjust their algorithms to accommodate a new reality where LLM "hallucination" is the new fat-fingering. LLM-generated retail order flow will undoubtedly still be considered dumb, but profit margins of firms like Citadel might take a beating.

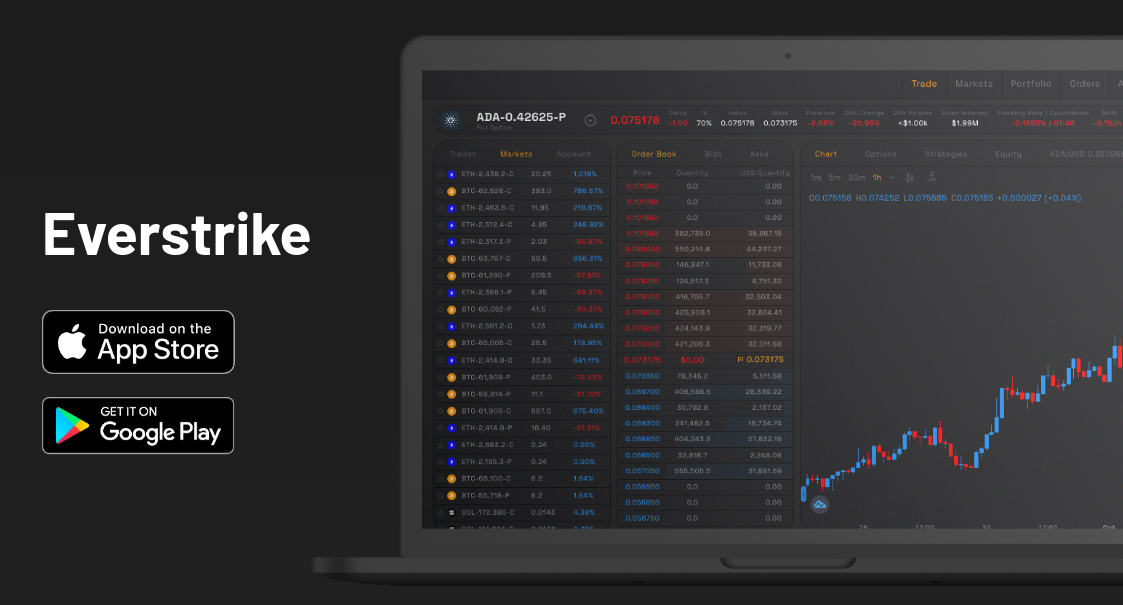

Try prompt trading directly in your browser (no signup needed).