How An Obscure OTC-Traded Derivative From the 80's Took Over Crypto

This is the story of the perpetual future - a financial derivative that went from being an obscure OTC-traded derivative that nobody cared about - to being the largest and most successful derivative in the crypto space, trading more than $18T annually.

The Inception: Late 1980's Hong Kong

The story of the perpetual future began in the late 1980's, when gold miners in China got annoyed about the way that futures contracts on the Chinese Gold and Silver Exchange of Hong Kong worked. Like practically any miner with solid risk management in place, miners on the Chinese Gold and Silver Exchange would hedge the value of their production output by short-selling futures contracts.

However, there was a problem. Periodically, the futures contracts that they were short-selling would expire, and they would need to replace them with new futures contracts. This would often be quite an expensive process. Not only were there significant transactions costs associated with doing this (market makers were demanding significant spreads), but the Chinese miners also lost a ton of money due to a concept known as basis risk.

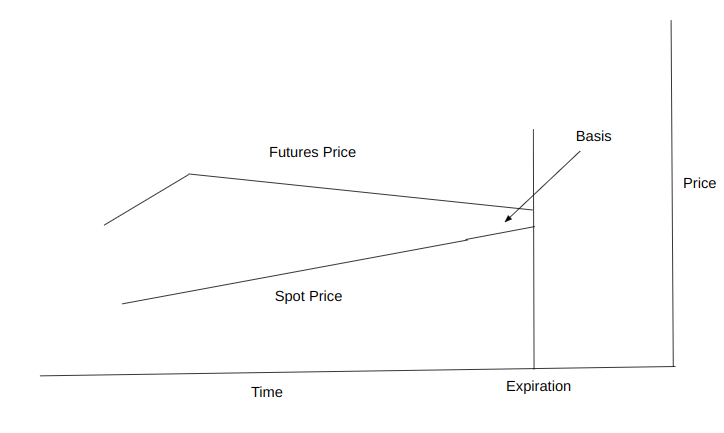

Basis risk happens when the price of a futures contracts doesn't converge with the spot price of its underlying asset on the date of expiration. In the case of the Chinese gold miners, their futures contracts would expire at a price slightly above the market price of gold. This would create a loss for the miners, since they would only be able to sell their gold at, say, $1,800/oz, while they would need to pay $1,810/oz to close their short position in the futures market. This difference in pricing can happen for a number of reasons - but usually it's because of the uncertainties around delivery (remember that these futures contracts are often physically settled and that their underlying assets will need to be physically delivered directly to the buyer - which can incur substantial transportation costs).

These losses pissed off the miners so much that the Chinese Gold and Silver Exchange introduced an entirely new derivative - the undated futures contract. With this contract, there was no expiration date. This meant that no contracts ever had to be replaced - a huge win for the miners, who were used to paying a large amount of money in transaction costs, every time they had to replace a contract.

The undated futures contract also had another very unique property: Every night, an interest payment would be exchanged between the holders of the contract and its short-sellers. This interest payment would effectively eliminate the contango/backwardation on the contract, and keep the price of the contract perfectly aligned with the spot price of its underlying asset.

These two properties together - the elimination of expiration, and the elimination of contango/backwardation, led to massive cost savings for the miners. They could short-sell their contracts - and keep their positions for as long as they wanted. Once they were ready to exit their positions, they could do so without losing money on the basis. Their fill prices upon exit would be almost identical to the spot price of gold - the only difference would be the spread that the market maker was charging. This saved them a substantial amount of money in the long run.

The Birth of the Perpetual Future

The success of the undated futures contract was never really a big deal outside Hong Kong. The product wasn't ported to any other exchanges (perhaps because other exchanges feared it would lead to less trading, and in turn, less fees to be collected from market participants).

It did, however, attract the attention of academics. Four years later, American economist Robert Shiller, formalized the concept of the undated futures contract, and gave it a new name: "the perpetual future."

The perpetual future, as devised by Shiller, was meant to be used for infrequently-priced, illiquid assets, such as single-family homes, and sparsely traded stocks and indices. Because these markets often had very significant spreads, Shiller believed that it could save hedgers a ton of money in transaction costs. And because these markets weren't very efficient, they often carried significant basis risk - something that the perpetual future could effectively eliminate.

Shiller's research provided the perpetual future with some legitimacy - but it still struggled to take off. Outside Hong Kong, it was traded almost exclusively OTC - with no exchanges officially adopting it. It joined the club of a myriad of other exotic derivatives (from "barrier options" to "variance swaps") that had largely failed to gain any mainstream attention.

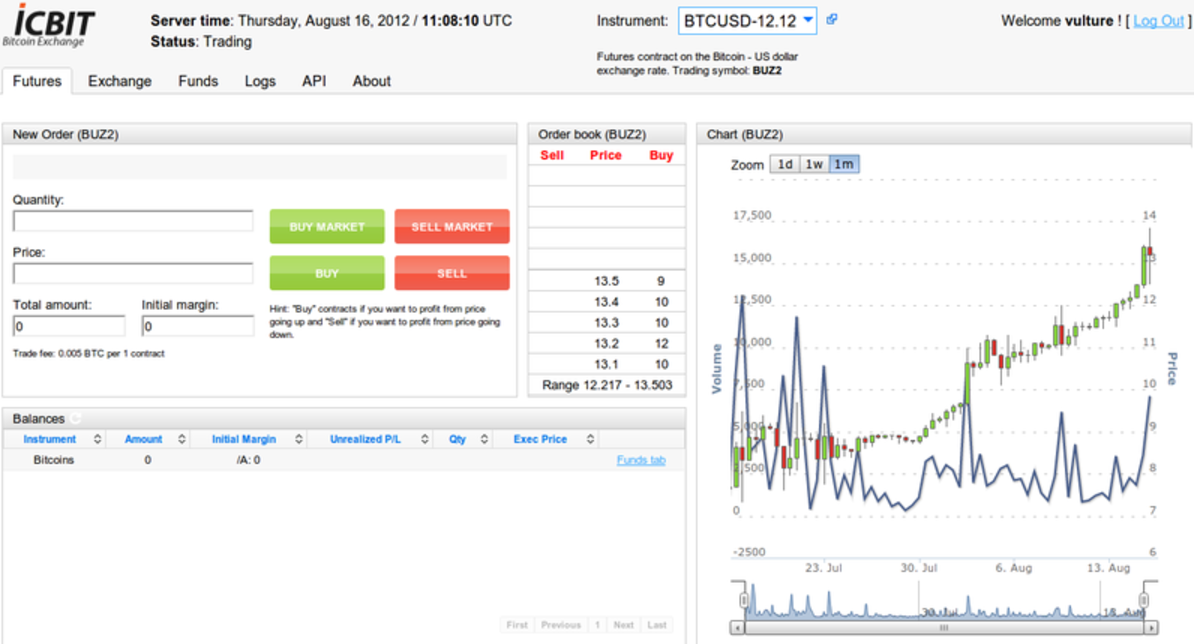

Icbit and Bitcoinica

It wasn't until 2011, when Russian crypto entrepreneur Alexey Bragin came across Shiller's paper, that the perpetual future started to enter the spotlight again. Bragin was launching a new Bitcoin futures exchange, and was looking for a way to differentiate himself from the existing Bitcoin futures exchange at the time, Bitcoinica. He found the perpetual future interesting, since it could solve some of the liquidity problems that Bitcoinica was facing (their liquidity was fragmented across a multitude of different contracts), and because of its interest mechanism, which could keep its price close to the spot price of Bitcoin.

Bragin's exchange went live in November 2011 (under the name "Icbit"), and featured an inverse version of the perpetual future (settled in Bitcoin, but priced in USD). The contract had daily interest exchanges (Bragin referred to these exchanges as "funding" - a term that would hang on and became the main term for any perpetual future-based interest exchange in the future).

While Icbit did manage to outlast its competitor, Bitcoinica (whose founder turned out to be fraudulent), it never really became a big success, and was acquired in 2014.

Bitmex

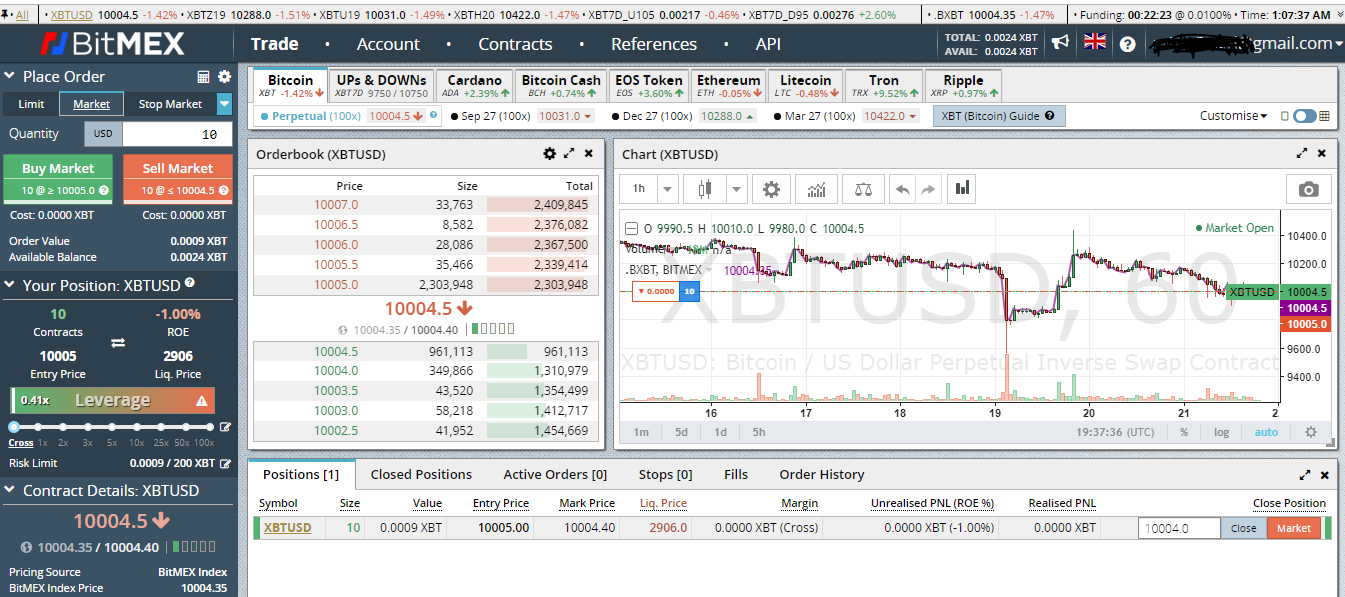

2014 was also the year that Bitmex was launched (a new and promising Bitcoin futures exchange that would later turn into a billion dollar company). Bitmex had the option of offering the perpetual future as their flagship product, like Icbit had done - but decided to go with the plain vanilla future instead. At the time, their main competitors were OKCoin (a Chinese spot and futures exchange, with later Binance founder Changpeng Zhao serving as CTO), and Cryptofacilities (a UK crypto startup focused on futures). Neither of these offered perpetual futures.

In 2016, after two years of little-to-no volume, and massive liquidity problems, Bitmex decided to switch gears. Their plain vanilla futures markets had largely failed to amass any significant liquidity, so it seemed logical to shut some of them down, and replace them with a single perpetual futures contract.

In May 2016, the XBTUSD was born - an inverse Bitcoin perpetual future, priced in USD, and settled in BTC. The XBTUSD featured a maximum leverage of 100x - a leverage way above the industry standard at the time. Bitmex subsequently terminated four of their six plain vanilla futures markets, and began marketing the XBTUSD as their flagship product.

As part of Bitmex's marketing effort, Bitmex founder Arthur Hayes would hold in-person seminars, where he would explain the concept of funding to traders unfamiliar with the perpetual future, and teach them how to do spot-futures arbitrage (hedging the value of your spot BTC, while collecting daily interest payments).

The XBTUSD became a massive success, and made Bitmex the #1 crypto derivatives exchange in terms of volume. Throughout most of 2019, and during the first half of 2020, the XBTUSD was where all of the Bitcoin price action took place - if you didn't have a XBTUSD tab open, you were missing out. Large price moves originated on the XBTUSD, and the Bitmex "trollbox" was the equivalent of the 18th century London coffeehouse - full of ordinary people discussing markets and politics.

Eventually, in late 2020, Bitmex began facing regulatory trouble, and traders started migrating to competing futures exchanges, such as Binance Futures and FTX. The perpetual future, however, continued to be the king of crypto derivatives. FTX started offering linear perpetual futures (contracts that were not only priced in USD, but also margined in USD). These contracts turned out to be more flexible than their inverse counterparts (thanks to the relative ease at which exchanges can add new market pairs), and quickly became the industry standard.

Today

Today, in 2023, the perpetual future remains the #1 derivative of the crypto space. It completely dwarfs other derivatives, such as the plain vanilla future, and trades in excess of $50bn a day. There are perpetual futures not only for Bitcoin, but also for hundreds of other cryptocurrencies.

A derivative, that started out as a niche product (only trading OTC, and on the Chinese Gold and Silver Exchange) has effectively turned into the most important derivative of the crypto space. And all of this has happened in less than 10 years.

The only question is: Which exotic derivative will be the next?

At Everstrike, we think it will be the perpetual option.