Market Making 101 — Part 2

In the last section of this series we covered the very basics of market making.

We covered the fundamentals that make market making a viable strategy and introduced the adverse selection problem.

In this article we will explore some simple ways to deal with the adverse selection problem.

Quick recap from the previous article: Adverse selection is what happens when someone is more informed than you. It’s how you end up losing money as a market maker. If you were to do a very naive market making strategy, where you simply copy the best bid and the best ask from the order book, and quote those prices yourself, you would end up losing a lot of money.

The steamroller analogy

Market making is often described as “picking up pennies in front of a steamroller”. This is a surprisingly accurate analogy.

The steamroller is the market. You have no way of knowing where it’s going. It might be stationary for a while, while it’s doing its work, and then suddenly take off in one direction. If you get run over by the steamroller, you might lose a leg or two.

The steamroller is surrounded by a huge pile of pennies. Anyone can pick up these pennies — but in order to pick them up, you must two basic rules.

The first rule

- Before picking up any pennies, you must purchase a ticket from the ticket seller.

Why? Because picking up pennies isn’t free. The steamroller is serviced by a company, and this company requires money to run.

You can think of the company as your broker or exchange. Your broker doesn’t control the market, but they require you to commit a certain amount of capital to participate in the market. This is like buying a ticket. Once you have successfully picked up your pennies, you’ll show your ticket at the exit, and get the money that you committed back. If you get run over by the steamroller, you’ll lose your ticket, and in turn, the money that you committed.

The amount of pennies you can pick up is directly correlated to the amount of capital that you commit. If you purchase the cheapest ticket, you’ll only be able to pick up a single penny. If you purchase the most expensive one, you’ll be able to pick up 100 pennies.

The more expensive the ticket, the more you can profit, and the more you can lose.

In practice, the amount of capital to commit will be guided by money management formulas such as the Kelly Criterion.

Professional market makers have been run over by the steamroller many times. They know their approximate chance of getting away in time, and will size their positions based on that. In a future article, we will cover position sizing in more detail.

Now for the second rule:

The second rule

- Before picking up your pennies, you must patiently wait for it to be your turn.

Market making is a very competitive space. You are not the only market maker out there. There are plenty of other people that also want to pick up free pennies.

The queue to pick up pennies is a basic FIFO (First-In-First-Out) queue. The earlier you get there, the sooner you get to pick up pennies.

Insiders

Now let’s imagine that you purchased a ticket, stood in line for a while, picked up some pennies and got your capital back.

0.001% return. Everything good.

Just repeat the process a few million times, until you are rich. Preferably by having some automated algorithm do the work for you.

Sounds good, right?

Not so fast. If you just pick up your pennies blindly, without paying attention to your surroundings, there’s a good chance that you will get run over too often, and will end up losing all your money.

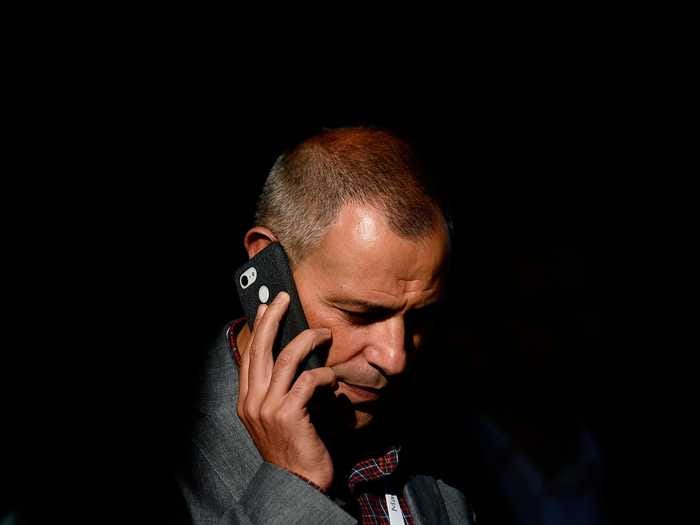

Why? Because some of the other people in the queue are insiders. These guys happen to know the guy driving the steamroller. The guy in the steamroller will pick up his phone and call them just before he decides to push the accelerator:

“Hey friends, I’m about to take off, leave the queue and get the fuck out if you don’t wanna get run over.”

The insiders will then abandon the queue and leave everyone else behind. Other people in the queue will naturally start following suit, as they think to themselves:

“Why are all these guys leaving the queue? Could they be insiders? I better leave as well.”

Some of them will make it out in time, and others won’t.

This is the adverse selection problem at play. Some people are simply more informed than others, and will have an edge based on that.

You can’t be an insider yourself (if you could, you wouldn’t be reading this article), but you can use the changes in your surroundings to your advantage.

Queue positioning

If you’re waiting to pick up the pennies, you MUST pay attention to the queue. If a huge amount of people are leaving the queue, you should probably leave as well.

There will always be some natural churn (people that get tired of waiting, or people that need to pee), but if half the people are leaving, there’s a good chance that something is up.

Furthermore, you must pay attention your position in the queue. Some positions are more advantageous than others.

If you’re in a very advantageous position, you want to be very careful about leaving.

An example of a very advantageous position is when the queue is super long, and you are in the front-most 20 percent. You want to have a very good reason for abandoning a queue position like that (e.g. half of the people behind you leaving).

Getting ahead in the queue

Let’s imagine that you are at the back of the queue, together with your friend, and that you guys want to get to the front fast.

What can you do?

If your friend is willing to cooperate, you might be able to play a few tricks.

Your friend will give up his position in queue. This will make other people nervous. They’ll start asking themselves: “Why is this guy leaving? Is he an insider?” Some of them might even leave.

This trick works best when your friend has bought a very expensive ticket. People will think: “Why is this whale leaving? Surely there must be something up?”

If executed correctly, this trick can net you several positions. It comes at the expense of your friend, who now has to rejoin the queue. Because of that, you only want to do it when both of you are at the back of the queue (and have nothing to lose, in terms of queue positioning).

Getting out in time

The further you are in the queue, the less chance of getting out in time. Why? Because the queue is facing the steamroller. When the steamroller starts rolling, the guys that stand furthest ahead in the queue will be the guys that get run over first.

The more people in the queue, the greater your chance of getting out in time.

The first guy to get run over will be the guy picking up the penny. This guy is doomed — UNLESS he can manage to a scratch. We’ll cover that next.

Scratching

If you are caught picking up the penny while the steamroller has just started rolling, all hope is not lost.

You can do something very unethical: You can pick up the penny and throw it at the next person in the queue. And then run like crazy.

If the next person in the queue is not paying attention, and hasn’t realized that the steamroller has started rolling yet, he will run towards the penny and try to pick it up. Now this guy will be in front, and you can get out safely.

The trading analogy to this is to place an Immediate-Or-Cancel order at the price your limit order got filled. If you got a bid filled, the order will need to be a SELL order. If it was an ask, it will need to be a BUY order.

The idea is to cancel out your newly opened position before the price level breaks. This way you won’t suffer any losses (except for the taker fees you pay on your Immediate-Or-Cancel order). The guy who suffers losses will be the guy who was behind you in the queue. This is called “scratching” a trade.

Scratching only works if there are people behind you in the queue (i.e. on the same price level as you) that are not paying attention.

But let’s be real — people tend to get a bit lazy while standing in queues for long periods of time. If the queue is long, there is a good chance that at least some of the people there are not paying attention. Maybe they are daydreaming, maybe they are talking to their friend, maybe they are looking the other way. This is your opportunity to cut your losses and avoid getting rolled over.

Scratching comes at a cost. You pay expensive taker fees to get your order filled quickly. Unless your taker fees are zero, you don’t wanna do it too often.

Tracking your queue position

Until now we have assumed that you always know your exact position in the queue. This is not an accurate assumption. In reality, the queue can be extremely long, and you may not always be capable of counting the amount of people standing in front of you.

This is where you need a sophisticated queue tracking system. All the pro market makers have their own queue tracking systems — which they dedicate a lot of resources to. Building one is not trivial — you will need to record every market event (people entering the queue, people leaving the queue, people getting filled), and chain these events together. In a future article, we will discuss how to create a simple one.

Conclusion

Market making is the bread and butter of many banks, hedge funds and proprietary trading firms.

In this article, we have explored the intrinsics of the market making queue, using a very simple steamroller analogy.

Topics we have covered:

- Why you should join the queue

- What it takes to join the queue

- Why you should know your position in the queue

- What you can do to get ahead in the queue

- How you can get out of the queue quickly, if you are caught

In a future article, we will explore how to adequately size your position, and how to accurately track your queue position. We will also explore some novel ways to detect insiders, and get out in time.