Perpetual Options - The Greeks

The greeks of a perpetual option are determined by two factors: Its money-ness (ITM, OTM, ATM) and its funding period.

In this article, we’ll explore the greeks of a perpetual option.

We will assume that the perpetual option has a funding period of 10 hours. We chose this particular period since it’s the default funding period on Everstrike.

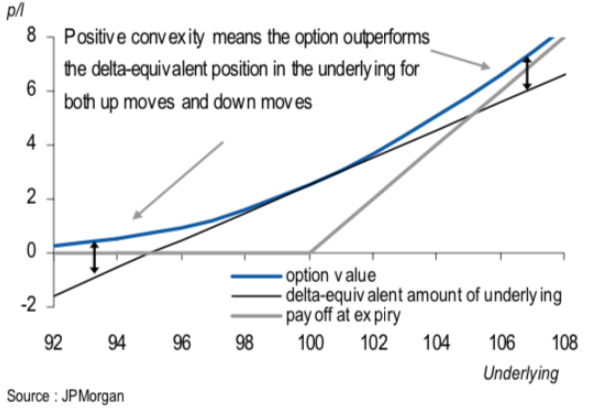

Gamma

The perpetual option provides continuous gamma exposure. The gamma is maximized when the perpetual option is ATM, and when the funding period is short.

A perpetual option with a funding period of 10 hours is effectively an intraday option. To understand why, check out the previous article in this series.

The closer to expiration an option is, the higher the gamma. This makes intraday options, and, in turn, the perpetual option, very high gamma.

The gamma is maximized when the option is ATM. Perpetual options with floating strikes (pinned to a relatively short average, such as the 21-hour EMA) are ATM most of the time, making them the best option for traders wanting continuous and cheap gamma exposure.

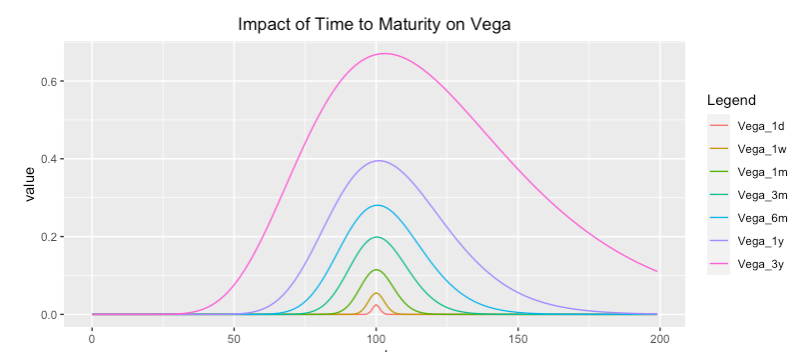

Vega

A perpetual option with a 10 hour funding period tends to have a really low vega. Why? Because it’s effectively an intraday option. Intraday options have really low vega, because they expire soon, and aren’t impacted by volatility in the same way as longer-dated options.

Perpetual options with a larger funding period (such as 7 days) will have higher vega, but are not common in practice.

If you’re looking for forward volatility exposure, a typical perpetual option is not the way to go. You’d be better off buying a longer-dated European-style option or trading a volatility index.

Theta

The theta decay of an option grows progressively bigger and more severe, as the option gets closer to expiration. While a perpetual option with a funding period of 10 hours does not expire per se, it can be effectively thought of as an intraday option. This makes the theta decay of this particular type of perpetual option very high. Every funding period carries a large theta decay along with it, and as such also a large cost for holders of the option (funding payment). The funding payment is maximized when the perpetual option is ATM and the implied volatility of the underlier is high.

Holding a perpetual option is a constant dilemma: You want to maintain your gamma exposure, but you don’t want to pay any additional funding. At the same time, sellers are constantly wondering: “Are we collecting enough funding? Can it cover our losses if there is a big move in the underlier?”

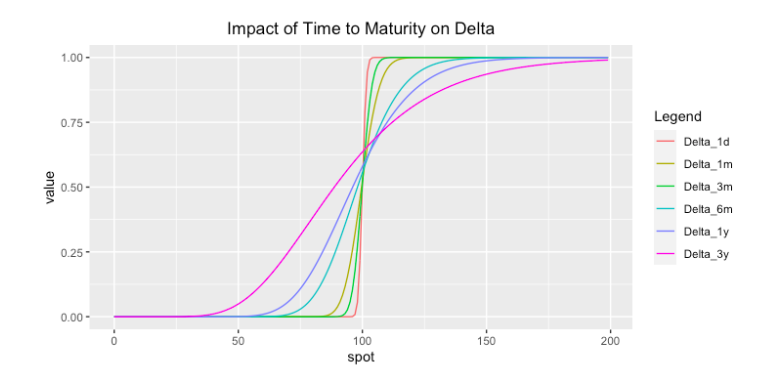

Delta

Since perpetual options with a funding period of 10 hours effectively behave like intraday options, the absolute value of their delta (AbsDelta) tends to be higher, on average, than for regular European-style options.

Conclusion

The perpetual option in its vanilla form (funding period of 10 hours) provides high and continuous gamma exposure, high and continuous theta decay, and low exposure to vega.

For the vast majority of traders, options is all about gamma and theta. For them, this type of perpetual option either provides a cost-efficient and convenient way of maximizing their gamma exposure over time, or it provides a way for them to collect a steady stream of funding payments, while being short volatility.

For traders that want to directly capture changes in forward volatility, rather than spot volatility, longer-dated European-style options and niche perpetual options (perpetual options with a large funding period) would both be a better choice.