The Ultimate Guide to Scalping Crypto

Is "scalping" a viable trading strategy? Only if you do it the right way. This guide provides an overview of the three main types of scalping, and how they relate to other trading strategies (such as swing trading and market making).

Is “scalping” a viable trading strategy? Only if you do it the right way. This guide provides an overview of the three main types of scalping, and how they relate to other trading strategies (such as swing trading and market making).

Contents

- What is Scalping?

- Holding Period

- Profit Target

- Types of Scalping

- Trend Following Scalping

- Mean Reversion Scalping

- Order Book Scalping

- Scalping vs Market Making

- Fees and Scalping

- Volatility Scalping

- Scalping Crypto

- Wrapping Up

1. What is Scalping?

Scalping is a trading strategy that seeks to profit from small movements in price or volatility.

It is one of five main trading strategies:

- Position trading (directional)

- Swing trading (directional)

- Scalping (directional)

- Arbitrage (non-directional)

- Market making (mostly non-directional, but can be directional)

Like position trading and swing trading, scalping is directional. The scalper asserts, with relative confidence (probability greater than 50 percent), that the price (or volatility) will move in a certain direction.

2. Holding Period

A common misconception about scalping is that it only works on very short time-frames (such as the 1-minute or 5-minute chart). This is wrong. Scalping can be employed on any time-frame — even larger time-frames like the daily time-frame is suitable for scalping. The key difference compared to swing trading and position trading is not the holding period, but rather the magnitude of the relative price movement that the strategy seeks to exploit.

A scalping strategy that works on the daily time-frame may require holding positions overnight, but as opposed to a swing trading strategy on the same time-frame, it will close open positions much sooner. Whereas a swing trading strategy on the daily time-frame could keep positions open for months, the scalping strategy will generally try to close open positions within days or weeks.

3. Profit Target

Scalping strategies tend to employ very conservative profit targets (ranging from less than a basis point to a few percent, based on the time-frame the scalper is trading).

The logic is to “lock in the profit” and “abandon ship”, before the trend reverses, and the ship starts sinking.

Scalpers understand the danger of greed, and will rather miss out on potential profit than be caught in a brutal reversal.

Many beginner scalpers will keep looking at the price action of the market they are trading, even after closing their position in profit, and get upset about closing their position early: “Why did I close my position early? I could have made so much more money, had I only left it open.”

More experienced scalpers understand that it’s a game of probabilities, and that there will inevitably be lost opportunities. For them, it’s not about lost opportunities, but rather about expected value — if the expected value of their strategy is positive over the long term, they don’t really care about only capturing a very small part of a trend, or missing out on significant profit.

An experienced scalper will maintain a watch-list of markets he is prepared to scalp, and use filters to identify opportunities. Once he is done scalping a specific market, he will move on to the next (and completely stop looking at the one he just scalped). Beginner scalpers, on the other hand, will often cling on to the markets they have been trading, and get upset if they miss out on profit.

4. Types of Scalping

Scalping can generally be divided into three sub-categories:

- Trend following scalping

- Mean reversion scalping

- Order book scalping

5. Trend Following Scalping

Trend following scalping seeks to profit from breakouts and momentum. A trend following scalper will look for sudden spikes in volume and diversions away from the mean.

An example is the Keltner Channels breakout strategy, where the scalper jumps on a trend if the price diverges more than X ATR’s (average true ranges) away from the mean, accompanied by a statistically significant spike in volume.

Unlike regular trend following strategies, the scalper will not stick around until the trend is exhausted, but rather close his position prematurely, locking in profit, and allowing him to movte on to another trend.

The trend following scalper tends to favor a low risk-reward ratio, leading to a low win-rate and a high win/loss ratio.

6. Mean Reversion Scalping

Mean reversion scalping is the opposite of trend following scalping — here, the trader always trades against the trend, seeking to profit from the inevitable pullback.

A good mean reversion scalper will enter his position long after the trend following scalper has exited his, leaving only the greedy “apes” (retail “traders” that see a coin up by 20% and decide to “ape” in on a long, or see a coin down by 20% and decide to “ape” in on a short), and liquidated traders, as his counterparties.

As with any strategy that goes against the trend, mean reversion scalping is associated with having massive balls. Mean reversion scalpers are essentially betting against retail FOMO — and as we have seen countless times before, FOMO can last much longer than you would realistically expect.

On the other hand, mean reversion scalping has a very attractive quality — it directly seeks to profit from liquidations. At the height of a trend, there will inevitably be a ton of liquidations (from overleveraged shorts, if it’s an uptrend, or from overleveraged longs, if it’s an downtrend). Those liquidations will cascade and lead to “unnatural” spikes — spikes that are short-lived in nature and immediately subside, once there are no more traders left to liquidate. Getting in on this forced buying or selling, and counter trading it, can be very profitable. Grid trading is a form of automated mean reversion scalping that, when configured right, manages to profit from exactly this.

Experienced mean reversion scalpers understand that most pullbacks are short-lived in nature, and that trends are likely to continue, solely by the nature of being trends. Therefore, they will often try to exit their position early, locking in a small amount of profit, and wait for the trend to start “spiking” again, before making another entry.

In contrast to trend following strategies, mean reversion strategies tend to have high winrates and low win/loss ratios. A single loss can easily wipe out the gains from 10 wins. This makes mean reversion great for general morale (the trader will tend to see a steady string of wins), but subject to periodic slumps (a big loss can wipe out many wins, temporarily demoralizing the trader).

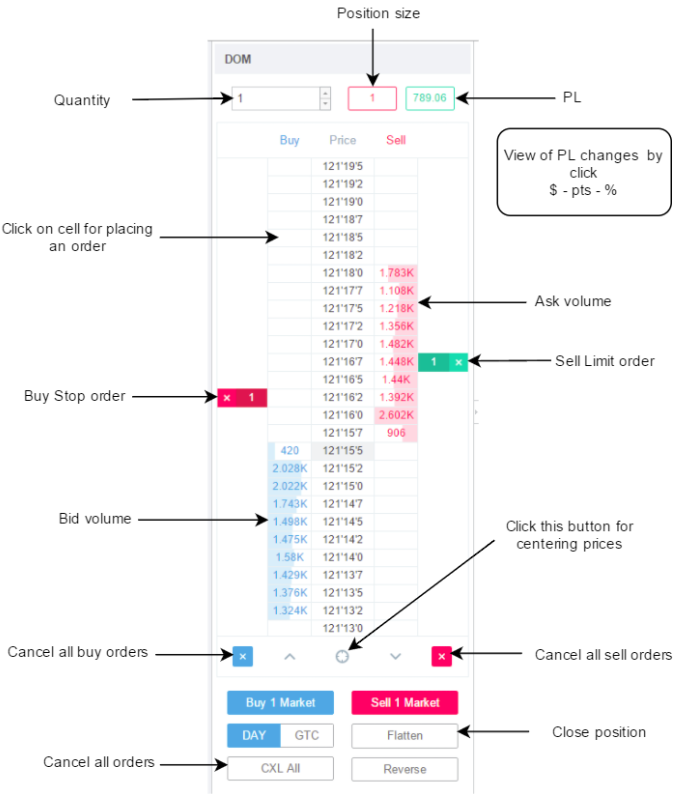

7. Order Book Scalping

While trend following and mean reversion scalping tend to use the candlestick chart as their main source of reference, order book scalping attempts to use the order book instead.

A significant amount of alpha can sometimes be derived from the order book, such as the presence and directional bias of whales. Order book scalping attempts to exploit this, by analyzing the bids and asks, and making qualified assumptions on what will happen to these during the next X time periods.

While trend following scalping and mean reversion scalping can be applied to any time-frame, order book scalping tends to work best on very short time-frames, sometimes spanning as low as a few seconds.

A Depth of Market (DOM) is essential for order book scalping, as it enables the scalper to rapidly submit and cancel orders, and visualize his own orders relative to the orders of other market participants. An order book scalper might submit and cancel hundreds of orders per minute, leading to very low fill-ratios. The speed of order execution, while important to any scalping strategy, is especially important to order book scalpers, as a delay of a few hundred milliseconds can mean the difference between getting filled and not getting filled.

Order book scalping tends to have variable win-rates and win-loss ratios, which depend completely on the risk-reward ratio of the individual scalper. Some order book scalpers may have a 1 tick profit target, and a 5 tick stop loss, while other order book scalpers may have the opposite.

While some order book scalpers rely solely on the order book (the DOM), others will rely on both the order book and the chart, and often combine the strategy with one of the other scalping strategies (trend following scalping or mean reversion scalping).

8. Scalping vs Market Making

Scalping strategies can rely on taking liquidity, providing liquidity, or both.

When relying primarily on providing liquidity, they share some key similarities with market making, and are often confused for being market making strategies, rather than scalping strategies.

Let’s do a quick recap on market making.

Market making is when you quote both sides of the book, with the intention of capturing the bid-ask spread. Market making can be unhedged (directional) or hedged (non-directional). Unhedged, directional market making share some similarities with scalping, as it attempts to capture a small movement in price (the bid-ask spread).

The key difference is that the market maker starts quoting both sides of the book, while the scalper only quotes one side. Once the market maker has been filled on one side, he may resort to exclusively quoting the opposite side, attempting to lock in the spread. At that point, the market making strategy effectively becomes one-and-one with scalping.

While a scalper in general only quotes one side of the book, he may, in certain situations, quote both sides, just like the market maker. This happens when he is scalping multiple time-frames at once, attempting to go long on one time-frame, and short on another. In this specific case, his scalping strategy becomes visually indistinguishable from market making.

Mean reversion scalping is especially similar to directional market making, as they both tend to employ a high win-rate, coupled with a low win-loss ratio. “Picking up pennies in front of the steamroller” is a popular term that people use for both.

9. Fees and Scalping

Fees are obviously very important to scalping strategies, as a large fee can effectively make a scalping strategy non-viable.

Scalping strategies with a profit target of 3 basis points or less generally need to rely on passive limit orders, as the taker fee and spread associated with orders that cross the spread often surpasses their profit target.

Scalping strategies with a profit target above 3 basis points can rely on both passive limit orders and active limit (or market) orders. The decision on whether to use a passive limit order or an active one is left to the discretion of the trader.

A good scalper will use a combination of passive and active orders to achieve his profit target, while generally favoring passive ones (due to the option of capturing the spread and, in general, paying lower fees).

Having low taker fees opens up new opportunities for the scalper, such as being able to “scratch” his own positions. A “scratch” happens when the trader is filled on one side of the spread, and later realizes that the price is about to move against him. To prevent losing an entire price increment (a tick, or a pip), he closes his position at break-even, using an active limit order. His net loss is the taker fee associated with this order.

Scratching works best when two conditions are present:

- Low taker fees

- Large price increments/tick sizes

10. Volatility Scalping

Scalping is not limited to movements in price. Movements in volatility may also present a profitable opportunity for scalping. Just like price, volatility tends to move in trends, and is eventually mean-reverting. This makes volatility suitable for trend following scalping or mean reversion scalping.

Options and volatility indices (VIX) are the most common ways of scalping volatility.

11. Scalping Crypto

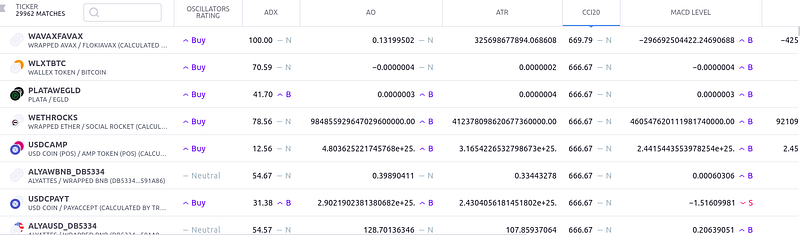

Cryptocurrency markets are especially suitable for scalping, since they tend to exhibit the following characteristics:

- Open 24/7

- High volatility (ATR%) relative to forex, indices and major equities

While crypto markets in general carry higher execution costs (spread, fees) than forex, the increase in volatility more than makes up for that.

The downside of scalping crypto relative to forex is the fact that most crypto platforms are not really suitable for scalping at all.

Traditionally, crypto exchanges have been built with the buy-and-hold clientele in mind, and have only recently started catering to daytraders and swing traders.

Tools such as Metatrader are generally not available, and the interfaces lack key features such as the DOM, point-and-click trading and dynamic order quantity calculation.

On the other hand, crypto exchanges tend to provide better and more powerful API’s, relative to forex brokers, making it easier for crypto scalpers to automate their scalping strategies.

12. Wrapping Up

If you made it this far: congratulations. You now know the three main forms of scalping, how scalping relates to market making and other trading strategies, the impact of fees and price increments on scalping, and the application of scalping to crypto.

This super-guide is periodically updated with new concepts and explanations, so make sure to check back in a few months time from now for an even better insight on what scalping really is.