Why You Should NEVER Short Perpetual Futures

Shorting perpetual futures is TERRIBLE risk reward. Here's what you should do instead.

Shorting perpetual futures caps your gain at 100%, while subjecting you to potentially UNLIMITED losses.

Any trader worth his salt knows that this is BAD risk reward.

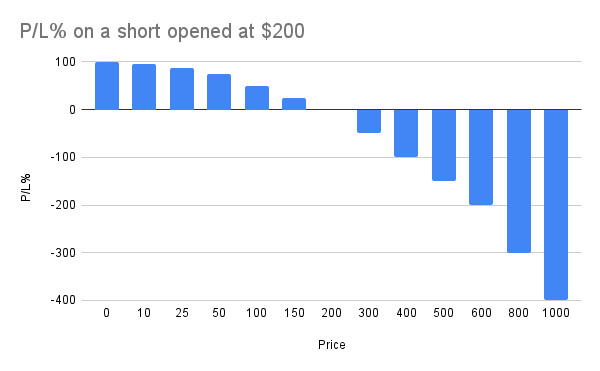

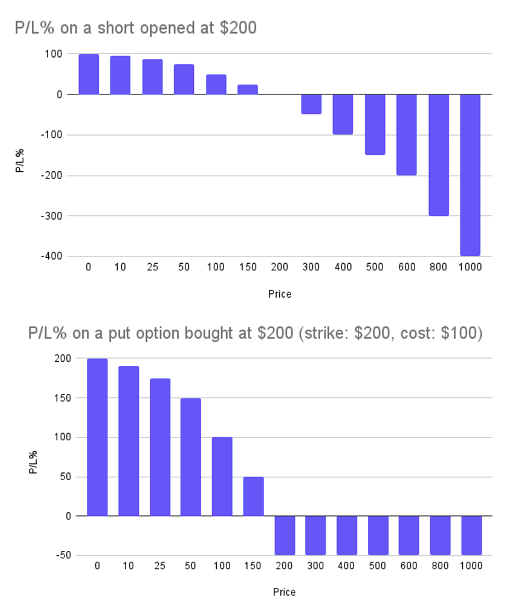

Here’s a chart that illustrates what I mean:

In the BEST case scenario (price goes to zero), you gain only 100%.

In the WORST case scenario (price goes to 1000 or above), you lose 400% or more.

The risk-reward is skewed against you from the beginning.

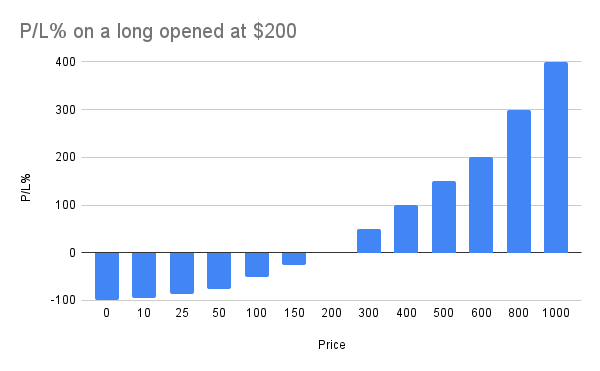

Not surprisingly, the risk reward for a long is the exact opposite:

Being long caps your losses at 100%, while allowing for potentially unlimited profits.

THIS is how most people get rich, and why most people prefer being long.

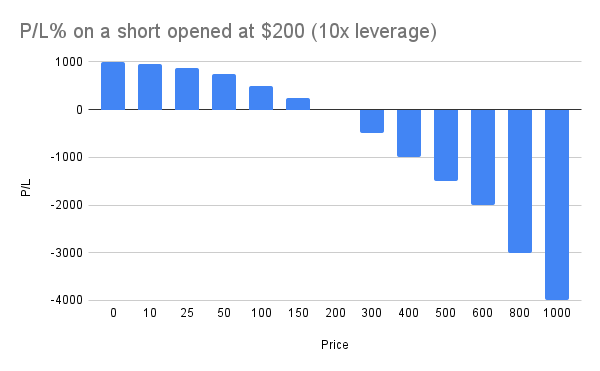

“Oh, but I’ll just use leverage”

Leverage doesn’t change the flawed risk reward, it only amplifies it:

On top of that, it comes with the risk of being liquidated. Even on the lowest possible leverage (2x), the price only needs to double to liquidate you.

The game is rigged

When the game is rigged, there is only one way to win: By not playing.

Don’t short a perpetual future. The risk reward is simply not worth it.

Shorts are disadvantaged from the beginning.

You may think you are clever by using leverage — but you are not. The leverage only amplifies the flawed risk reward.

“But, I’m a bear. What am I supposed to do?”

Bears need to think creatively to survive.

There are a couple of ways to reverse the terrible risk reward that we just saw — so that it looks almost exactly like being long. Limited downside and huge upside.

We’ll talk about the most popular way to do this now.

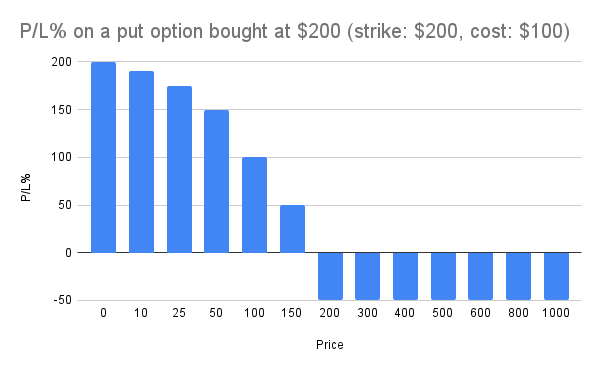

Buy a put option

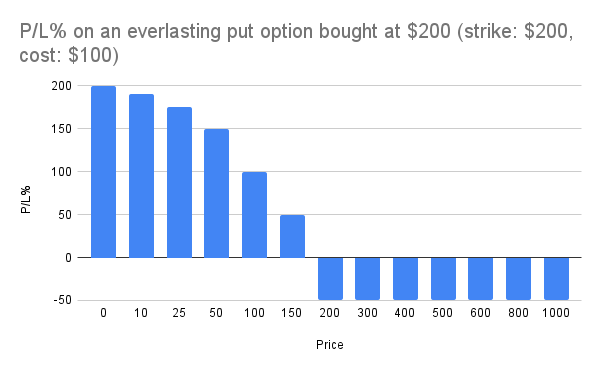

When you buy a put option, you flip the script. Now you are the one who has good risk reward:

We see that the put option outperforms the short in almost every scenario:

The only scenario in which the short outperforms the put option is when the price doesn’t move (stays at $200). In all other scenarios, the put option outperforms the short.

However, there’s a CATCH.

The put option has a TIME COMPONENT attached to it. For the put option to yield the P/L pictured above, the price movement must happen within a SPECIFIC amount of time. If the put option expires BEFORE the movement has happened, the P/L% will always be -50%.

We can get around this by purchasing a PERPETUAL put option.

Perpetual put options

A perpetual put option is a put option that doesn’t expire. The chart pictured below is true FOREVER (and not just until expiration).

Really solid risk reward, huh?

There’s only one problem.

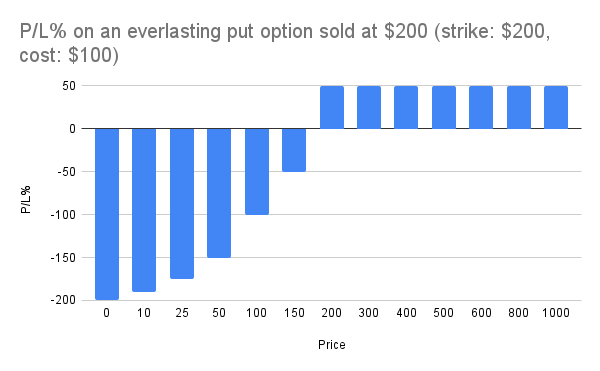

Who would even want to sell us an option like this?

Their risk reward would look the opposite of ours:

It turns out that some people are actually willing to take on this unfavorable level of risk reward.

But only if they get compensated with a “funding fee”.

Funding

If you have traded perpetual futures before, you are already familiar with the concept of funding.

Every few hours, a payment is exchanged between longs and shorts. The funding rate determines the size of the payment, and the side that pays.

If the funding rate is negative, shorts pay longs.

If the funding rate is positive, longs pay shorts.

The amount to be paid is equal to the position size, times the funding rate:

Funding Payment = Funding Rate * Position Size

Perpetual options have exactly the same funding mechanism.

Except, for perpetual options, the funding rate is often much, much higher.

This is because it’s much more valuable to be long on a perpetual option than it is to be long on a perpetual future.

As we saw before, the risk profile of being long on a perpetual option is really, really good. And the risk profile of being short is really, really bad. So shorts must be compensated adequately for offering options for sale — and that’s how we get insane funding rates of 10% per hour.

Funding and risk reward

How does funding affect the risk reward of our perpetual put option?

Let’s take a look at some examples.

We’ll assume a funding rate of 20% a week.

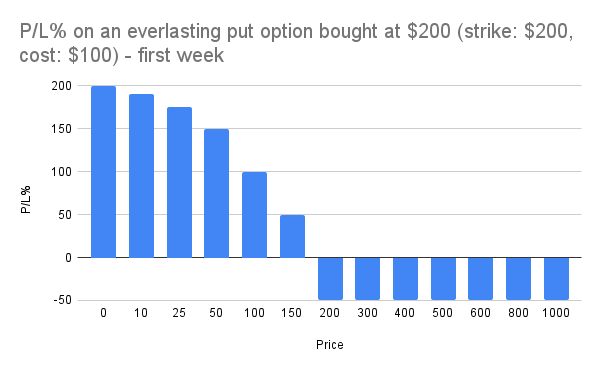

First week:

We haven’t paid any funding yet, so the risk reward is the same as before. Really good.

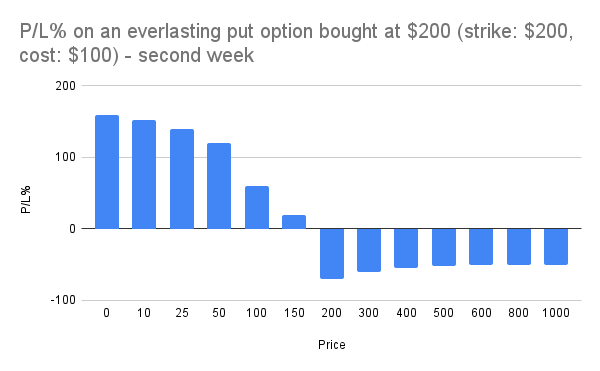

Second week:

Here, we have paid a single funding payment. The size of the payment is 20% of the value of our put option.

This has made our risk reward slightly worse.

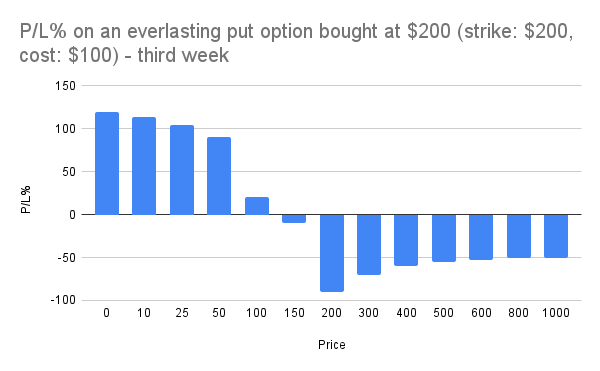

Third week:

After paying our second funding payment, our risk reward has gotten a lot closer to being symmetrical. It’s no longer a favorable risk reward.

If we continue for a few more weeks, the risk reward will begin to look outright terrible.

The Cost of Time

Big gains are made from asymmetrical risk rewards.

Buying put options yields a risk reward that is much, much more favorable than simply shorting futures.

But the risk reward comes at a cost — for every day and week that goes by, the risk reward gets slightly worse.

At some point, it will look just as bad as when shorting futures — and eventually, it will look even worse.

If you’re reasonably sure that the downwards price movement will happen NOW, or within a SPECIFIC amount of time — BUY PUT OPTIONS.

If you’re not so sure — just SIT BACK and do NOTHING. Put options will break your bank, and the terrible risk reward of shorting futures is simply NOT worth it.