Is CeFi Less Secure Than DeFi?

We often hear that CeFi is less secure than DeFi. But is that really the case? This article will explore the question in-depth.

Value Lost Per Dollar Traded (VLPDT)

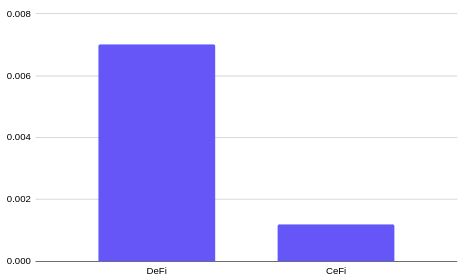

When evaluating the security of an exchange (or an entire ecosystem, like CeFi and DeFi), a key metric is VLPDT (value lost per dollar traded).

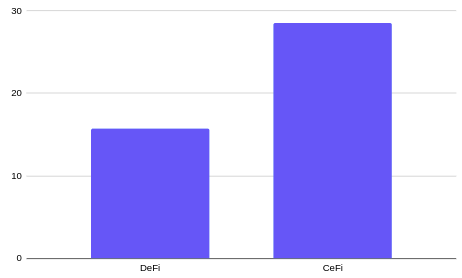

Throughout the last 3 years, DeFi users have accumulated a total loss of $15.75b. 39% of that has been attributed of hacks and exploits. The remaining losses were a result of fraud and theft. Less than $1b have been recovered thus far.

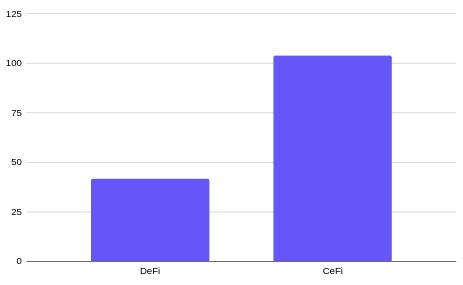

CeFi users, on the other hand, have suffered a total loss a $28.54b, within the same time period. This number includes $1.78b lost in 2020, $7.71b lost in 2021, $8.9b lost on FTX, $4.7b lost on Celsius and $5.46b lost in other incidents (the Genesis insolvency being the biggest of these).

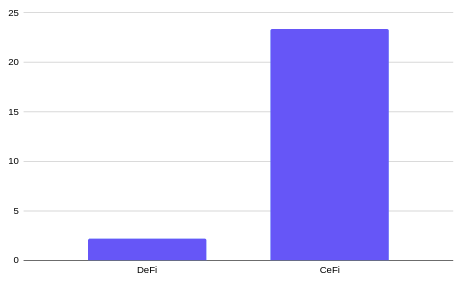

From that data alone, it would be easy to conclude that DeFi is more secure than CeFi. However, it would fail to take into account the fact that CeFi processes a trading volume that is an order of magnitude higher than that of DeFi.

Between 2020 and 2023, DeFi has processed a total trading volume of just $2.254T. CeFi, on the other hand, has processed a total trading volume of $23.36T, or 1,036% that of DeFi.

Between 2020 and 2023, DeFi users lost $0.0070 per dollar traded. CeFi users, on the other hand, lost just $0.0012 per dollar traded. That makes CeFi 582% more secure, when measuring security with the value lost per dollar traded (VLPDT) method.

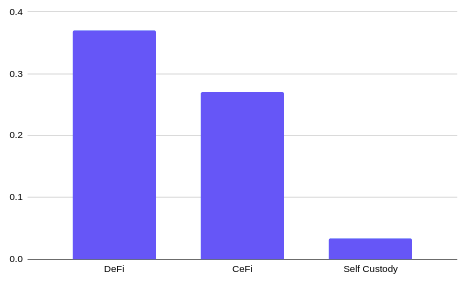

Value Lost Per Dollar Stored (VLPDS)

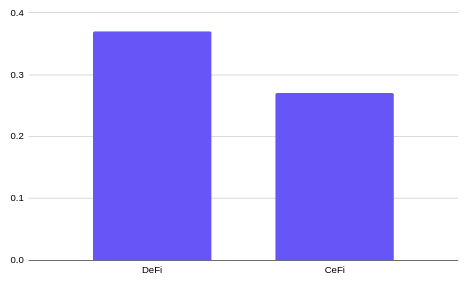

Our analysis would not be complete without also considering the value lost per dollar stored (VLPDS).

DeFi currently has a TVL (total value locked) of $41.74b. This is in contrast to CeFi, where the top 20 exchanges currently hold $104b in assets.

DeFi users lost $0.37 per dollar stored, between 2020 and 2023. CeFi users, on the other hand, lost only $0.27 per dollar stored, within the same time period. In other words, CeFi is 37% more secure, when measuring security using the VLDPS method.

Conclusion

CeFi is often touted as being less secure than DeFi. Indeed, CeFi users have lost almost double that of DeFi users throughout the last 3 years. However, people often forget that CeFi hold 249% more value than DeFi, and that CeFi processes an annual trading volume that is an order of magnitude higher than that of DeFi. Based on that, it would not be fair to categorize CeFi as being less secure than DeFi.

Self Custody

Self custody, while often described as the safest way of storing crypto, is not without problems either. 4 million Bitcoin (worth $120b by the time this article was written), is estimated to be lost forever. That represents 20.62% of the outstanding supply (19.4M), and 19.04% of the total supply (21M).

Since 2009, users that store Bitcoin on their own have collectively lost $0.2062 per dollar stored ($0.015 per dollar stored, per year). Users that store Ether on their own have collectively lost $0.004 per dollar stored ($0.00064 per dollar stored, per year).

Despite that, self custody is still significantly more secure than both CeFi and DeFi. The VLPDS of self custody is just $0.011 per year, making it 794% more secure than CeFi, and 1,088% more secure than DeFi, when measured using this method.