Wash Trading Gone Wrong - How A $100M/Day Crypto Exchange Accidentally Bankrupted Itself

This is the story of BaseFEX - a crypto exchange that unintentionally bankrupted itself through wash trading.

It's a cautionary tale for any crypto exchange looking to get ahead by faking volume - and a solid guide for anyone who knows a bit of coding, and wants to take advantage of shady crypto exchanges.

The founding of BaseFEX

The BaseFEX crypto exchange was created in early 2019, by two Chinese nationals (Jesse Wu and Randolf Zhou).

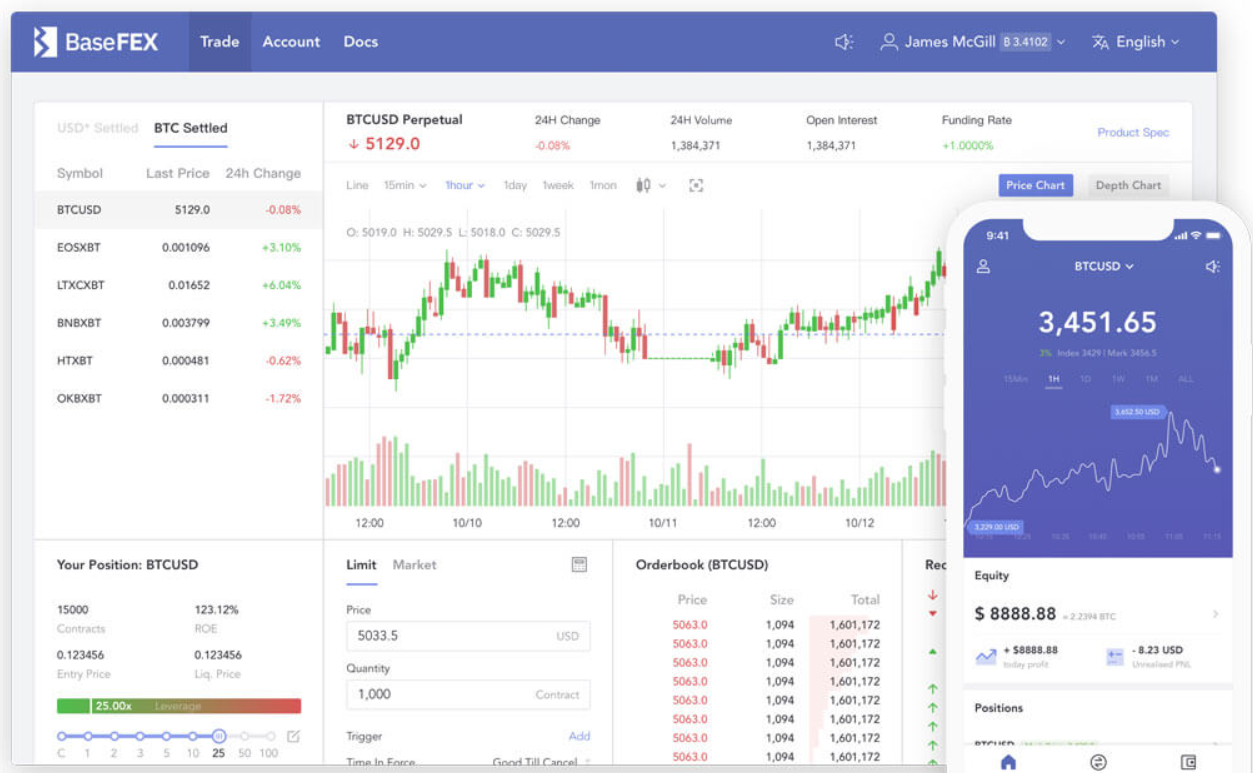

It marketed itself as a "Bitmex alternative", and featured a slick UI.

The exchange had a rough start. Its documentation was copied straight off of the Bitmex site, which caused people on Bitcointalk (where the exchange was originally announced) to start questioning its legitimacy.

Nonetheless, BaseFEX was eager to rise in the ranks and become the next Bitmex.

Faking volume

After being listed on Coinmarketcap and a number of other sites, BaseFEX did what many exchanges also do: Fake volume.

Faking volume allowed the site to climb in the rankings on these sites, which exposed it to a greater audience of people, and, ultimately, more customers. Because the site had large volume numbers, potential customers immediately thought that it was legitimate.

However, there was a problem: Its way of faking volume was rudimentary, to say the least.

There are three different ways of faking volume.

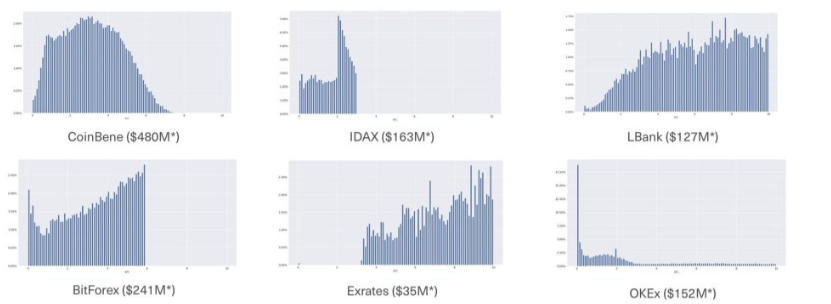

1. Printing fake trades

In this volume faking method, the exchange simply prints a ton of fake trades. The trades always take place within the spread, and the volume distribution of the trades is often uniform. No actual orders are submitted or matched.

2. Executing real trades, but within a network of bot accounts

This method is more subtle than the previous one, and harder to expose. It's possible that it has been used by many of the top exchanges in the past, including Binance (Binance boss, CZ, is allegedly in control of more than 300 Binance accounts). It requires the exchange to synchronize a large number of fake accounts, making it technically non-trivial to pull off.

3. Executing real trades, by having a bot account place random market orders

This method is the easiest to implement, and also the riskiest.

Every few seconds, a bot account on the exchange will place a randomly sized market order.

The market order will match with another order on the exchange. Typically (but not always), this order is a limit order placed by one of the market makers of the exchange.

If the market maker is the exchange itself (many crypto exchanges also act like bucket shops, and trade against their own customers), there is no harm done - the exchange will simply shuffle funds between two of its bot accounts.

If the market maker is someone else (such as a customer, acting as a market maker), the exchange is essentially paying the customer a spread. The spread can range from 0.01% to 1% of the value of the trade. If done repeatedly, this can cause the exchange to lose a huge amount of money.

BaseFEX

BaseFEX initially used the third method.

Every couple of seconds, a market order was submitted by a BaseFEX-controlled bot account. The market order was either a buy or a sell, and was matched with another order in the order book.

Throughout the course of a day, thousands of market orders were submitted, accumulating a trading volume in the hundreds of millions.

This went well in the beginning, since BaseFEX was also the sole market maker on its platform. The BaseFEX-controlled market maker account would absorb all of the market orders, and earn all of the spread.

However, it wasn't long until someone figured out a way to to take advantage of the scheme.

Bertyar88

Bertyar88 is a Russian Bitcointalk user, who came across BaseFEX in June 2019. At the time, he was unemployed, and had just $1,000 in his account.

After watching the platform for a while, he discovered that most of the volume there was fake - and came up with a way to take advantage of it.

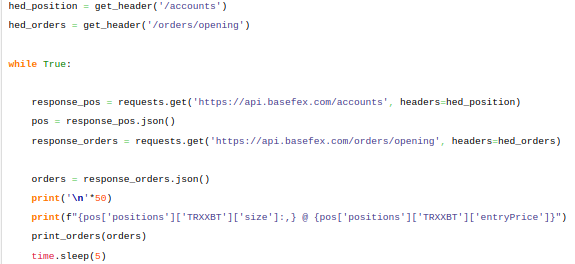

Armed with some rudimentary Python knowledge, Bertyar88 coded up a simple trading bot. The bot would place a limit order on each side of the order book on BaseFEX's TRX/XBT market, and periodically refresh the orders, as they were filled, or the price changed. In essence, his bot was a very simple market making bot.

While simple, the bot turned out to be a massive success.

It absorbed thousands of market orders per day, earning Bertyar88 a 0.05% spread every time it was filled.

Within one month, the bot achieved a 1,000% return, turning 0.3 BTC into 3 BTC.

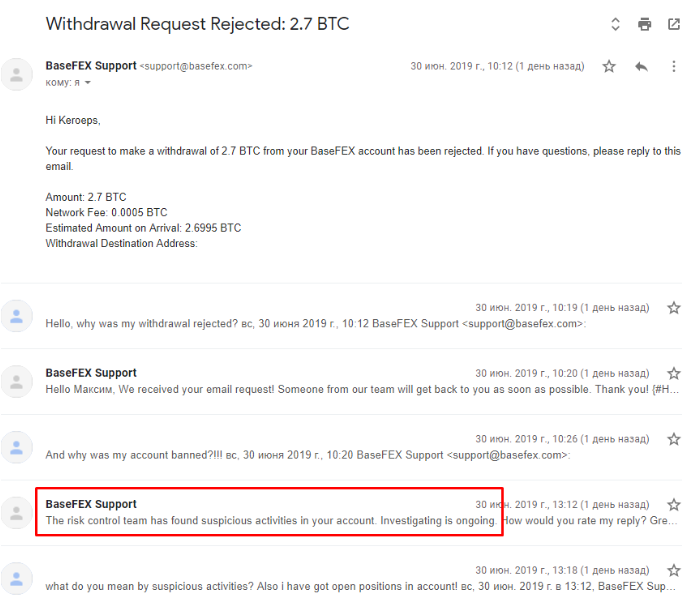

Bertyar88's bot went unnoticed for the most part. It was only when he tried to withdraw his earnings that the admins on BaseFEX discovered the bot. They immediately banned his account, and blocked the withdrawal.

Frightened by the fact that a single user could milk them for 2.7 BTC, the admins temporarily paused BaseFEX's wash trading bot.

The following day, BaseFEX's trading volume decreased by 99.99%.

The end of BaseFEX

Since discovering that their wash trading bot had been exploited, the admins on BaseFEX never dared to turn on the bot again.

BaseFEX slid down to the bottom of the rankings on Coinmarketcap, and gradually faded into oblivion.

The BaseFEX platform was taken offline sometime during 2021. The people behind the site have successfully managed to erase the site from the Wayback Machine - however, a number of Bitcointalk threads remain.

Bertyar88 never managed to withdraw his funds - his account never got unbanned, and his withdrawal was never processed.

However, he can at least comfort himself with the fact that he single-handedly managed to take down a $100M volume/day crypto exchange - with just $1,000 in savings, and 1,000 lines of Python.