Perpetual Options vs. European-Style Options - What's The Difference?

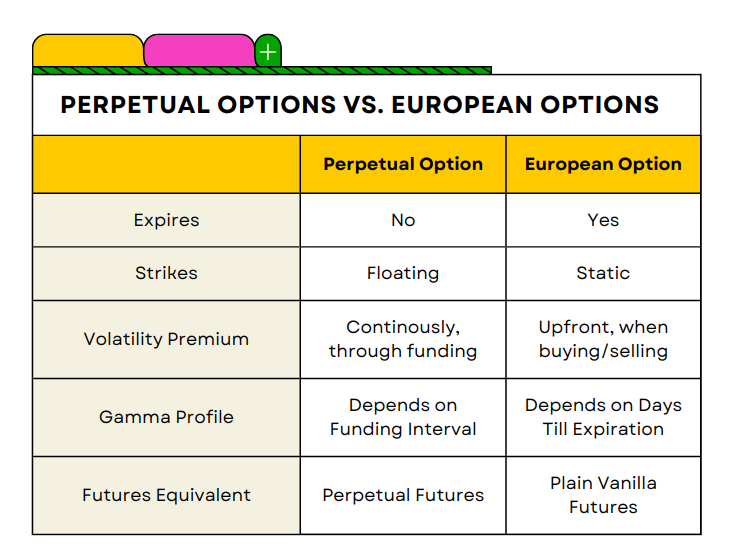

The perpetual option is a relatively new type of exotic option (introduced in 2021) that seeks to rival the traditional, European-style option.

It distinguishes itself by having no expiration, funding (a novel concept that makes the volatility premium continuous, rather than lump-sum), and floating strike prices (strike prices that follow the price movement of the underlier).

Expiration vs. No Expiration

Just like perpetual futures, perpetual options have no expiration. This makes them quite a lot simpler than traditional European-style options.

Instead of having to deal with 3 variables (expiration, strike price, market value), you now only have to deal with two (strike price and market value).

When you are buying perpetual options, your only concern (apart from choosing the strike price) is whether the market value of the option is fair. The market value of the option is determined by the two things - its market price, as seen in the order book, and its funding (more on this one later).

When you are buying European-style options, on the other hand, you not only need to consider the market value of the option, but also its expiration. You need to find the right expiration for your use-case (if your desired price movement doesn't happen prior to the expiration date, you end up losing a ton of money).

When is one better than the other?

If you are absolutely sure that your desired price movement will happen within a certain amount of time, choose a European-style option with an expiration that matches your time horizon.

If you are not sure about the time horizon, choose a perpetual option. Do note that the "funding interval" of the perpetual option needs to make sense (we will cover this one in detail later in this article).

Hourly Funding vs. Lump-sum Premiums

When you buy options, you are essentially buying insurance. Insurance can be bought either with an annual premium (large sum upfront) or with a monthly premium (minor sum each month). Buying European-style options is like buying insurance with an annual premium - you pay a large sum upfront, and if you later regret, and want to get out of your insurance, you are more or less out of luck.

With perpetual options, you pay the premium continuously, over time. Every hour, you pay a very small amount of premium. Over time, this adds up to the premium that you would pay upfront with an European-style option (and eventually even exceeds that). The difference is the level of flexibility that you have available to you, as a trader. If you sign a monthly insurance deal, and you don't like it, you can get out. Similarly, if you buy a perpetual option with an hourly premium, and you don't like it, you can get out. Your loss will be limited to the amount of premium you have paid so far.

However, if you decide to keep the perpetual option for a very long amount of time, you will likely end up overpaying (the annual premium, or lump-sum deal, will be cheaper).

This makes perpetual options superior for low-conviction trading (trading, where you are not 100% sure that a move will happen, and you want to be able to exit your position, if things don't work out), and European-style options superior for high-conviction trading (trading, where are you are almost 100% sure that a move will happen, and you have absolutely no need to exit your position prematurely).

Funding

The hourly premium that you pay as a holder of a perpetual option is called "funding". Funding is a zero-sum game (whatever the buyers end up paying, the sellers will end up earning). The amount of funding that you pay or receive every hour is determined by the "funding rate". If the funding rate is 10%, buyers will pay a premium that corresponds to 10% of their position size, and sellers will receive a premium that corresponds to 10% of their position size.

Different perpetual options may have different premiums, and, as such, may also have different funding rates. Perpetual options that are close to being at-the-money generally have the highest funding rates - while options that are deeply in-the-money have the lowest ones.

Writing Options

From a sellers perspective, would you rather collect an hourly premium, or a large sum upfront?

If you are an insurance broker, it depends entirely on your client. If your client is new, you would rather collect the large premium upfront (in case he or she cancels the deal prematurely). In my case, I have been with my insurance broker for years, so they would obviously rather collect a monthly premium (they know I'm not very likely to cancel, and that they can charge me more on the monthly plan). Selling options is slightly different, since the buyer of your insurance cannot cancel on you specifically (you are free to refuse to buy back the option, in which case he or she would need to offload the option to another buyer). Since there is no cancel risk, collecting the hourly premium is often gonna be the most profitable for you.

The only exception is when the premium becomes significantly worse right after you have sold the option (maybe the option moves from being at-the-money to being deeply in-the-money). Remember that the hourly premium isn't fixed (it may change significantly, as the total premium of the option changes). For this reason, collecting the large premium upfront may be desirable when you believe that the premium is high (in which case, you are essentially "locking it in", and hedging yourself against a decline in the premium in the future). Collecting the smaller, hourly premium may be desirable when you believe that the premium is low (in which case you are deliberately choosing not to "lock it in", allowing you to receive even larger premiums in the future).

Funding Intervals

Now that you know what funding is, lets have a quick look at the funding interval. The funding interval is the time period between each funding exchange.

In the previous section, we used a funding interval of 1 hour (buyers pay a part of their premium every hour). However, the funding interval doesn't need to be 1 hour (it can be anything that the buyer or seller agree on, or that is specified in the contract). Typically, the exchange platform on which you trade, will decide the funding interval. They might have different funding intervals for different perpetual options contracts.

The funding interval determines the "shortsightedness" of the option. If the funding interval is 1 hour, the option will be very shortsighted in nature. Buyers will be expecting to make a profit within hours or days. Neither buyers or sellers are generally concerned about price movements weeks or months in the future. The reason is that the funding paid will simply be too large for the buyers to sustain over the long run. A perpetual option with a funding interval of 1 hour comes with a large total premium (relative to an European-style option with an expiration of 1 month).

To see why that is the case, consider the insane flexibility of the option (you can essentially get rid of your option again, 1 hour after buying it, at almost no cost). Buyers are gonna want to be holding this option for hours or days - but not for weeks or months (the latter is simply gonna be too expensive). This "shortsightedness" of buyers of the option makes it behave like an intra-day European-style option. It will, on average, have higher gamma than other types of perpetual options, and its theta decay will be very high.

Other perpetual options, with longer funding intervals (e.g. 1 week) will be a lot less "shortsighted", and have much lower gamma and theta decays. The funding interval can be considered the expiration proxy of the perpetual option - while the perpetual option does not have an expiration, per se, it has something that closely resembles it (its funding interval).

Choosing The Right Funding Interval

Choosing the right funding interval is essential, when trading perpetual options. If your time horizon is hours or days, choose a short funding interval (e.g. 1 hour). If its weeks or months, choose a long funding interval (e.g. 1 week). If you don't choose the right funding interval, you may end up overpaying (as a buyer), or you may end up being underpaid (as a seller).

Fixed Strike Prices vs. Floating Strike Prices

Perpetual options can either have fixed strike prices (like European-style options) or floating strike prices (like Asian-style options).

Floating strike prices are generally preferred, since they allow the perpetual option to be relevant in perpetuity.

A fixed strike perpetual option has its relevancy tied to its strike price - if its strike price is no longer relevant, the option will no longer be relevant. This is problematic, for several reasons. Firstly, the option isn't truly perpetual (if the strike price becomes irrelevant, the option still exists, but it will no longer be traded, and is likely to be delisted). Secondly, the fixed strike perpetual option requires a much greater amount of available contracts, relative to its alternative, the floating strike perpetual option. This results in greater liquidity fragmentation, worse liquidity and wider spreads.

The floating strike perpetual option is not perfect by any means either - it has a greater level of path-dependency, relative to the fixed strike perpetual option (the payout of a floating strike options position depends not only the funding rate during the time the position was held, but also on the change to the average price of the underlying asset during that period). This can make it harder to price. For this reason, brokers and exchanges tend to use a long average as the basis for the floating strike price (100 hours is common), and they tend to revert to fixed strike prices when the funding interval is large (larger funding intervals tend to have a lot of uncertainty around the average).

Conclusion

The perpetual option distinguishes itself from the European-style option by having no expiration and by having hourly funding exchanges (volatility premium disbursed on an hourly basis rather than upfront). Most perpetual options have floating strike prices.

Choose a perpetual option, when you are not sure about the time horizon for your expected price movement, or when you are selling options, and you believe the current premium is low.

Make sure to choose an appropriate funding interval for your perpetual option (short funding intervals work best for short-term price movements).