The History Of Perpetual Derivatives

Perpetual derivatives have been in use since at least the early 1600's. Here's a quick recap of the three main perpetual derivatives and their history.

Perpetual Bonds

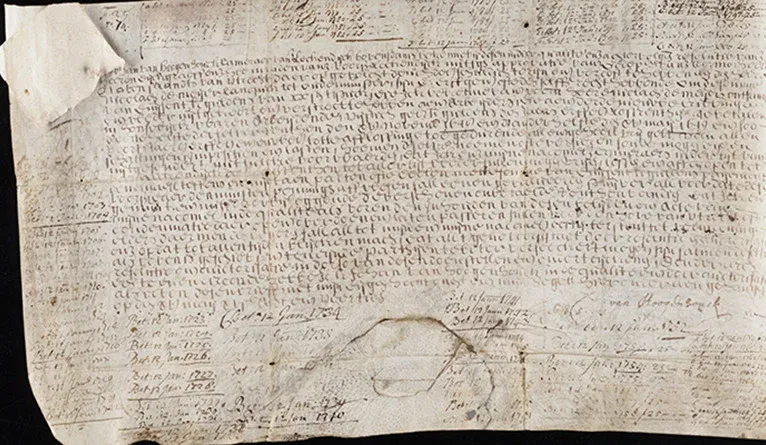

The history of perpetual derivatives ranges all the way back to 1624 when a local Dutch water authority (Lekdjik Bovendams) issued the world's first perpetual bond. The perpetual bond is a bond with no maturity date and no redemption obligation, enabling the issuer to retain the funds received from the bond indefinitely, with no obligation to pay any of them back, as long as the issuer pays the annual coupon. Think of it as a loan that lasts forever, but with annual interest payments. The annual interest payments enable the lender to recoup all of their capital within a certain amount of years.

Why issue a perpetual bond? If you want to borrow money, but don't want the loan to be subject to a repayment date, the perpetual bond is for you. You'll never have to pay the loan back. While that sounds like free money, there's a catch. You'll be subject to periodic interest payments, and these payments can quickly add up to an amount that surpasses the principal of the loan. In other words, unless the interest is lower than inflation, you'll still want to redeem the loan at some point.

Perpetual bonds were very popular among governments during the 18th, 19th and 20th centuries. They were used to access quick cash, to be used for wars and other endeavours. Interest rates ranged between 2% and 10% a year, and were often lowered over time. For example, the Bank of England gradually lowered the interest rate on their 1751 bonds from an initial 3.5% in 1751 to 2.5% in 1923. The bonds typically lasted between 10 and 200 years. The latest notable example of a redemption was in 2015, when the UK government redeemed perpetual bonds issued by Winston Churchill in 1927. These particular bonds were known as "consols", and paid an annual interest rate of 4%.

While most perpetual bonds are designed to be redeemable, a few make redemption impossible, allowing the holder to enjoy the interest payments in perpetuity. Technically, they are treated as equity (instead of debt). Unlike traditional equity, they do not have voting power attached. As such, the holder cannot influence the decisions of the issuer.

Today, perpetual bonds are primarily issued by banks, as a way to help fulfill their capital requirements.

Perpetual Futures

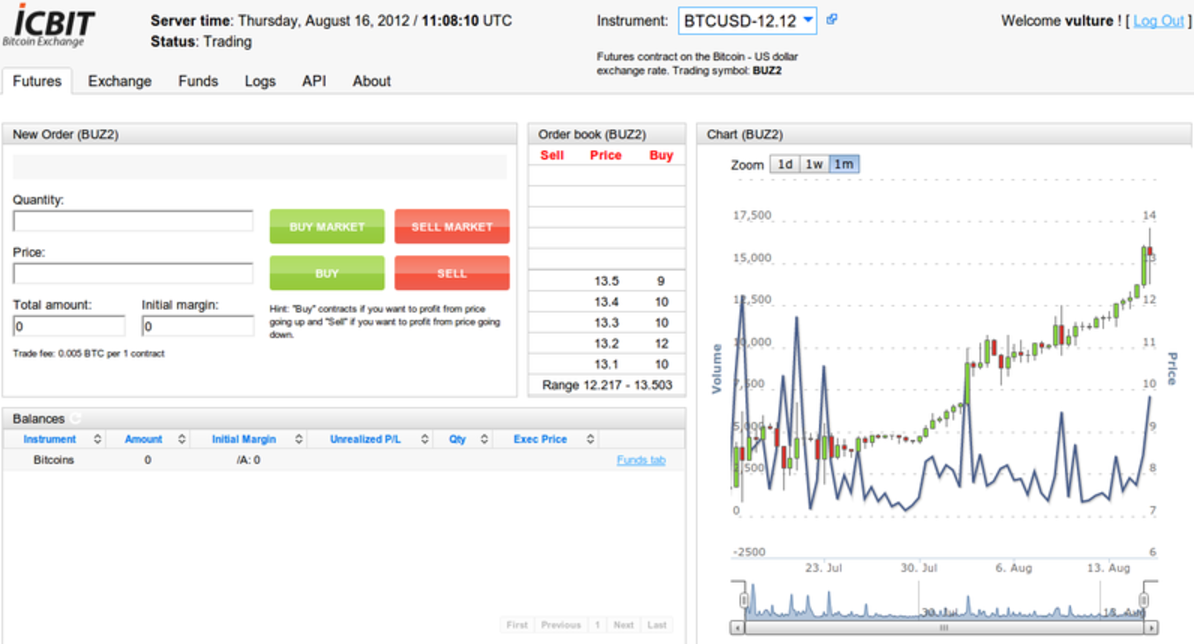

Perpetual futures contracts were invented in the late 1980's by researchers at the Chinese Gold and Silver Exchange Society of Hong Kong (CGSES), and formalized in 1993 by Robert Shiller. They provide a way to offer a futures contract without expiration, which can be useful for hedgers and speculators. If you have a field of crops, but you're not sure about the date at which you will sell these crops, the perpetual futures contract offers a simple way to "lock in" a sales price, hedging yourself against future price decreases. If you were to use traditional futures contracts for this instead, you'd run the risk of your contract expiring, leaving you without a hedge.

The perpetual futures contract became extremely popular in the cryptocurrency niche during the late 2010's, greatly surpassing the traditional futures contract in adoption, and capturing the bulk of the derivatives volume in the space.

Today, there are perpetual futures contracts on thousands of cryptocurrency assets, and on dozens of commodities, currencies and equities. Collectively, these contracts account for more than $10T in annual trading volume. The contracts exchange daily interest payments between holders and sellers (more commonly known as "funding") in excess of $10M.

Perpetual Options

The perpetual option is the latest perpetual derivative. It was formalized just 3 years ago, and has yet to see any significant adoption.

The history of the derivative dates back to 2021, when Dave White, a researcher at a crypto investment firm (Paradigm), introduced it in a research paper.

It provides a way to offer an options contract without expiration. As with the perpetual future, this can be useful if you want to hedge or speculate, but don't have a set date at which you want to end your hedge or speculative position.

The longest running perpetual options contracts have only been live for a little more than a year, making the perpetual option a new and exciting derivatives type with lots of potential to be uncovered.

With a growing number of venues now offering perpetual options contracts within the cryptocurrency niche, we'll soon see if it manages to become as popular as its predecessor, the perpetual future.