Perp DeFi Strategy Has A 240% Daily Funding Yield And Is Accessible To Anyone

This perpetual options strategy boasts a funding rate of 10% per hour.

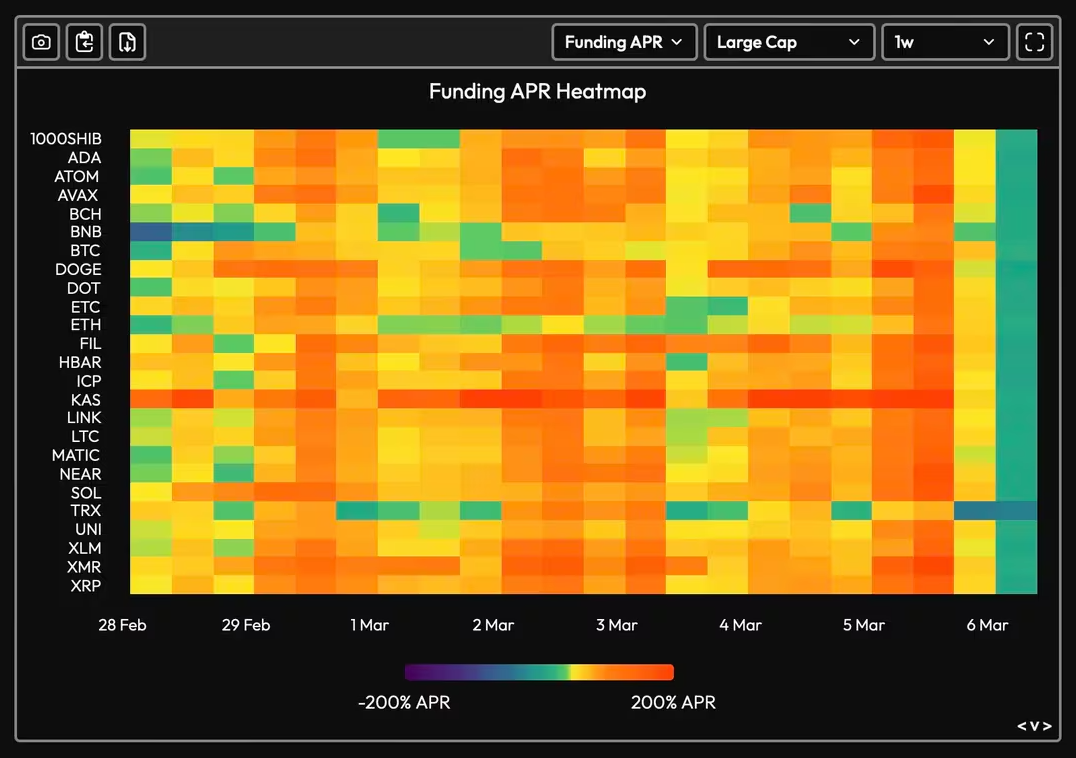

Selling perpetual covered calls on BTC is one of the easiest ways to harvest a high funding rate at the moment, with funding rates on at-the-money strikes approaching 10% per hour. The strategy enjoys a consistent daily yield in return for forfeiting further upside on BTC.

Selling covered call options may not be a popular strategy among Bitcoin bulls, but it's actually one of the easiest ways to earn a passive income on your BTC - as long as you are willing to temporarily give up any potential upside on your coins.

The perpetual option includes a funding rate that the seller of the option earns. The funding rate on an at-the-money perpetual option can be as large as 10% per hour on some strikes, allowing the seller to recoup 240% of their position size in less than 24 hours.

If you're keen to earn some yield on your BTC or ETH, and don't believe in any additional upside now that BTC has already reached almost $125,000, selling at-the-money perpetual covered call options on either could be strategy to consider - as it would net you a staggering 240% of your position size per day in passive funding gains.

As the crypto bull market draws on, high yield passive strategies such as the covered call will continue to be an attractive option for traders and investors that want to 'exit' the bull market and enjoy a passive return, without selling their coins.

Not only does the strategy boast an impressive passive return, but it's also a strategy that is widely accessible to the general public, with many crypto exchanges now offering options trading.

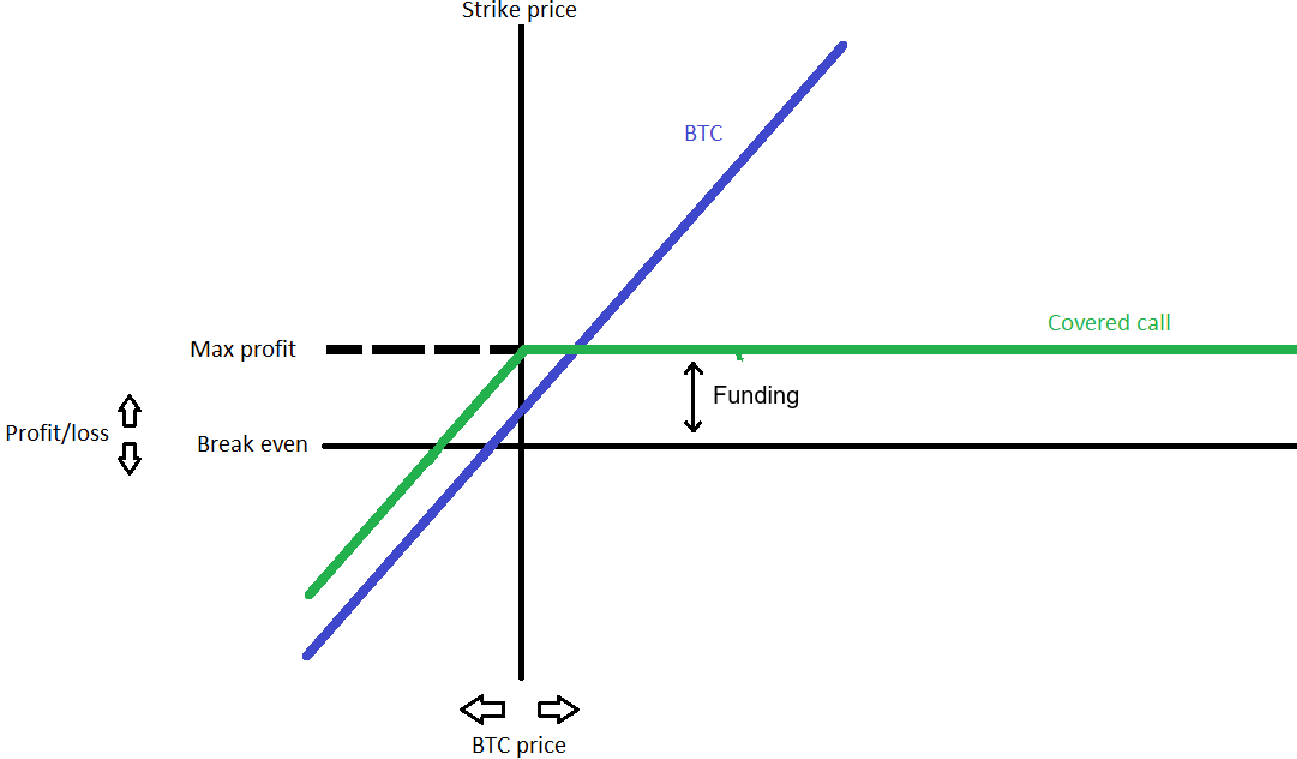

It works by selling one contract of a call option (i.e. a perpetual BTC call option) and holding a delta-equivalent amount of the underlier (i.e. 1 BTC). Any gains on the BTC is canceled out by a loss on the call option, disallowing the options-seller to earn on their BTC, but allowing them to earn a passive income on their position instead.

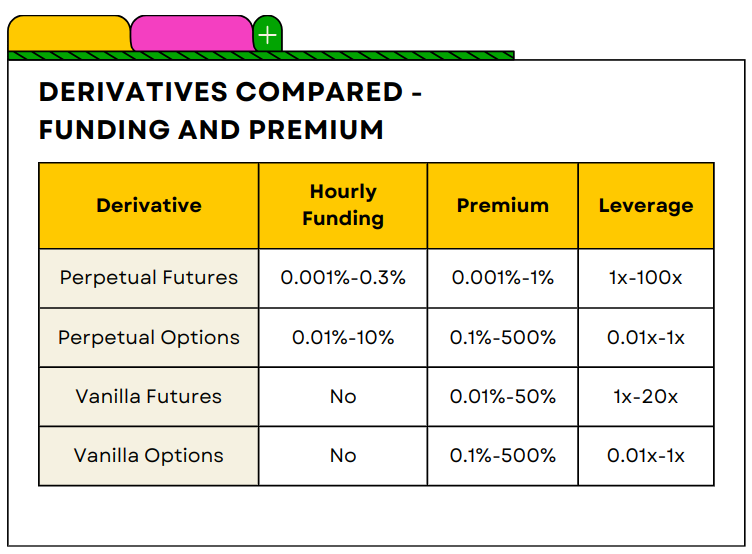

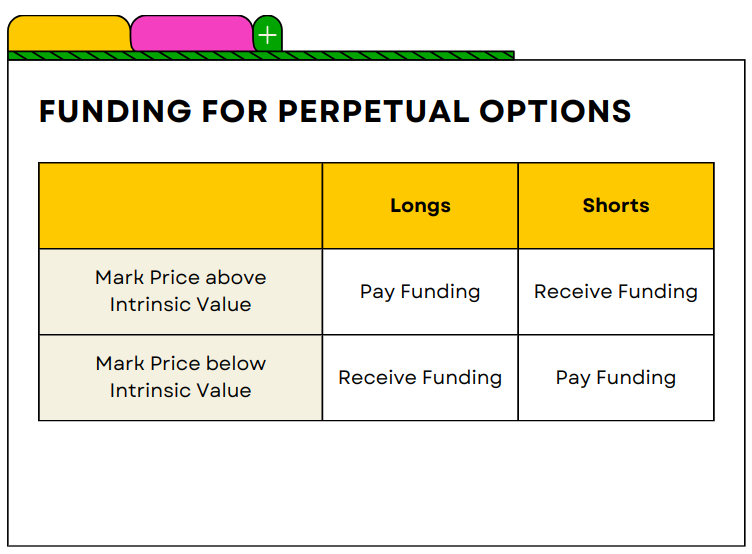

The passive income is either generated from theta decay (in the case of regular options) or from funding (in the case of perpetual options). Funding is well known to many crypto traders, since it's a core component of the perpetual future. However, not many are aware that perpetual options also provide funding, and often at much higher rates than perpetual futures.

The hourly funding rate for perpetual call options goes as high as 10% on some exchanges, allowing traders to have 10% of their position size credited to their account on an hourly basis.

The downside is of course not being able to enjoy any additional returns on one's BTC, while the covered call position is open. A downside that may be a deal-breaker to many, but may be acceptable to people who are temporarily neutral or bearish on BTC.

The previous bull market saw the emergence of a number of funding-related strategies, such as the 'funding cash and carry', where traders would short a perpetual future and hold an equivalent amount in spot, earning as much as 50% a year in funding.

So how much exactly can you earn on a perpetual BTC covered call position?

The short answer is that it depends on the margin requirements of your trading venue. To short a call option, a generous amount of margin is required, decreasing the APY of the strategy significantly.

On the largest perpetual options exchange at the time of writing this article (Everstrike), you'd currently need $6,100 to short one contract of an at-the-money perpetual call option. Shorting the contract would net you a funding income of $470 per day, which translates to a 0.48% daily return (or 583% annualized, when compounded daily). This does not include execution costs on opening and closing the position, which may decrease the APY slightly.

Of course, you'd have no guarantee that the funding rate on the contract would remain at 10% for an entire year. It could drop to levels that are no longer considered attractive to you, forcing you to rotate into a different, more lucrative strike price, and incurring additional execution costs.

In the event of a funding rate drop, some traders may choose to patiently wait for the funding rate to return to previous levels, while others may choose to exit the position immediately and rotate into a different position. There is no optimal strategy here - each trader needs to figure out what works for them.