7 Arbitrage Strategies That Are Still Accessible To Retail Quants In 2026

It's a common fallacy that only big firms / established players can do advanced latency- and execution-sensitive strategies such as HFT and arbitrage. In crypto, there have been at least a dozen such strategies that could be successfully run by a single person on their laptop for at least a year or two, and they continue to exist today (although the landscape is getting more competitive and bigger markets are now almost exclusively dominated by big players).

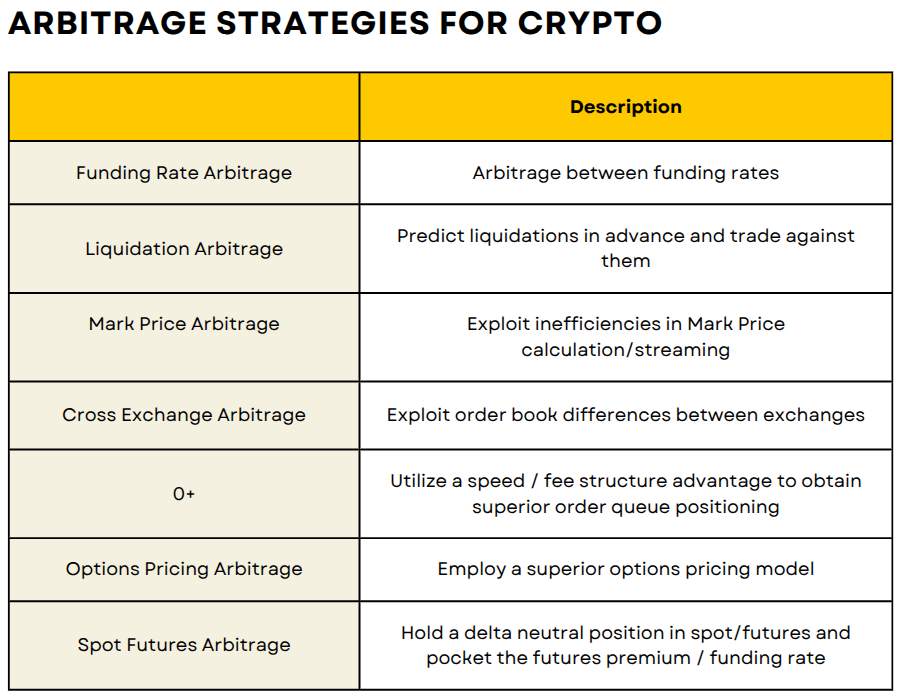

Here's a non-exhaustive list:

- Funding rate arbitrage

- Liquidation arbitrage

- Mark price arbitrage

- Cross-exchange (triangular) arbitrage

- 0+

- Spot futures arbitrage

- Options pricing arbitrage

Why retail arbitrage is still possible in crypto

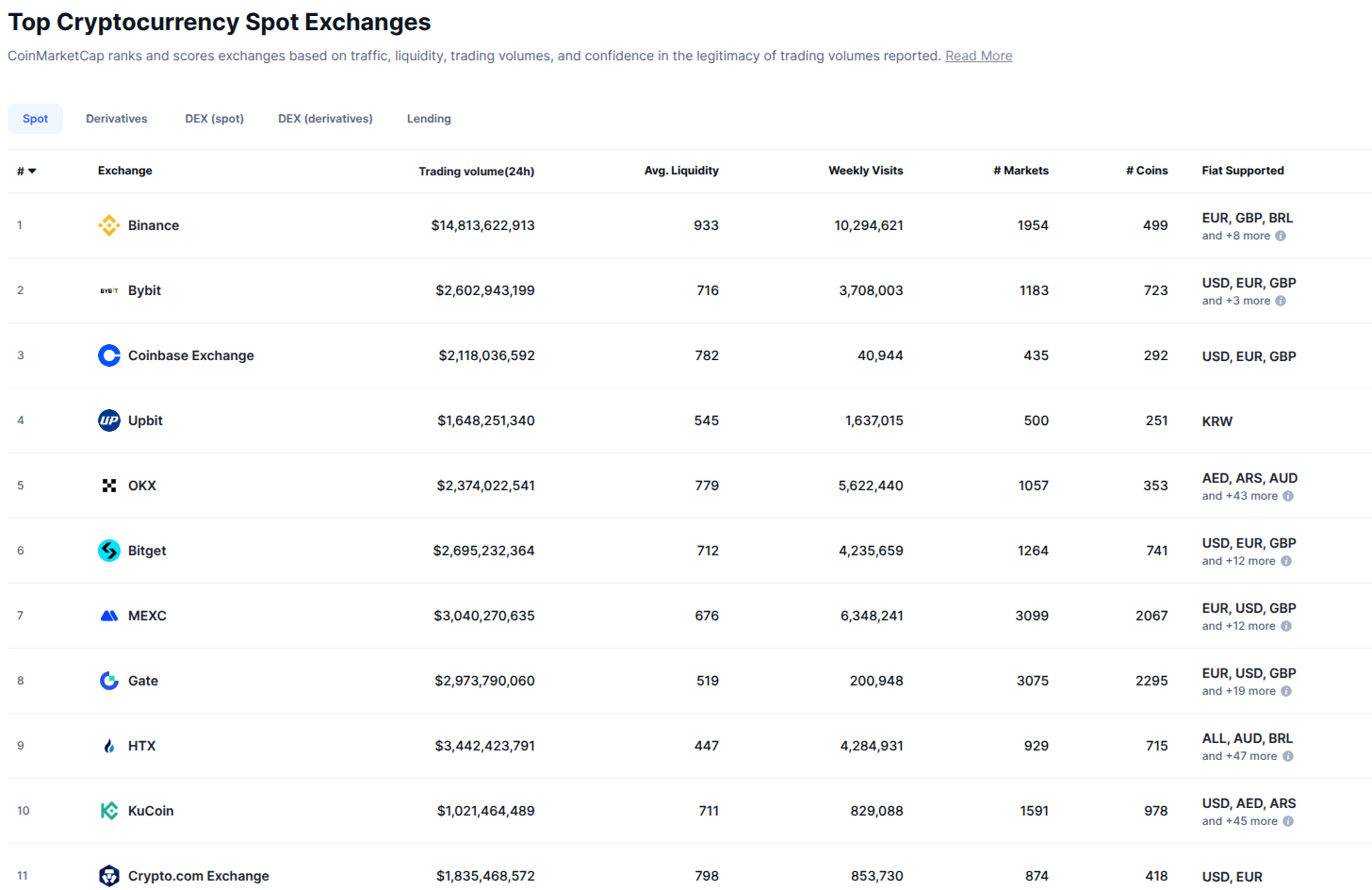

The great thing (or bad thing, depending on your view) about crypto is that there are thousands of different trading venues. It's a decentralized landscape where each venue operates independently from each other, and has its own set of participants and rules (fee schedule, API quirks, market microstructure). This makes crypto strikingly inefficient compared to traditional finance (where 90% of the trading takes place on a few select venues). The inefficiency and decentralization of the crypto trading landscape has birthed many great trading firms, including infamous and now defunct ones like Alameda Research.

Although the landscape has become somewhat more efficient with time, the sheer number of active venues that continue to exist and and pop up (despite constant rug pulls and exit scams) continues to provide a plethora of inefficient markets, and a horde of quants (solo, teamed or corped up) attempting to solve these inefficiencies and get filthy rich in the process.

The big players, as capital-rich they are, simply cannot yet devote enough resources to make every single market in crypto efficient. Not because they don't have the capital or manpower to do so, but because many of the markets simply do not yield enough profit to justify having a $200k/year quant working on them.

This is exceptionally good news for the hobby quant - just boot up your favorite editor, a few browser tabs with exchange API's, a terminal and get going. Many exchanges are trivial to get started with, and many even offer testnets that you can code and test against prior to messing around with real funds and deposits.

A quick note about venue/market selection

Selecting the right venue/market is a crucial step for any latency/execution-sensitive crypto trading strategy.

You don't want to end up overestimating your own capabilities and selecting a venue/market where you are competing against other players with significantly more resources than you. One example would be the BTC/USDT pair on Binance. Binance, being the largest exchange, has attracted many large players (including a number of TradFi juggernauts), and while these players may not be active on all of Binance's 500+ markets, they are almost guaranteed to be active on Binance's most popular market, BTC/USDT.

Instead, aim for a smaller and less saturated market. It could be a small cap on Binance that almost nobody is trading, or it could be BTC/USDT on a much less popular exchange.

Depending on your strategy, it may be necessary to collate multiple of such markets, and it may be necessary to interact with multiple exchange API's / deposit funds to multiple exchanges.

Now that this is out of the way, let's get into some of the strategies that can be employed by hobby quants in the crypto space today.

Funding rate arbitrage

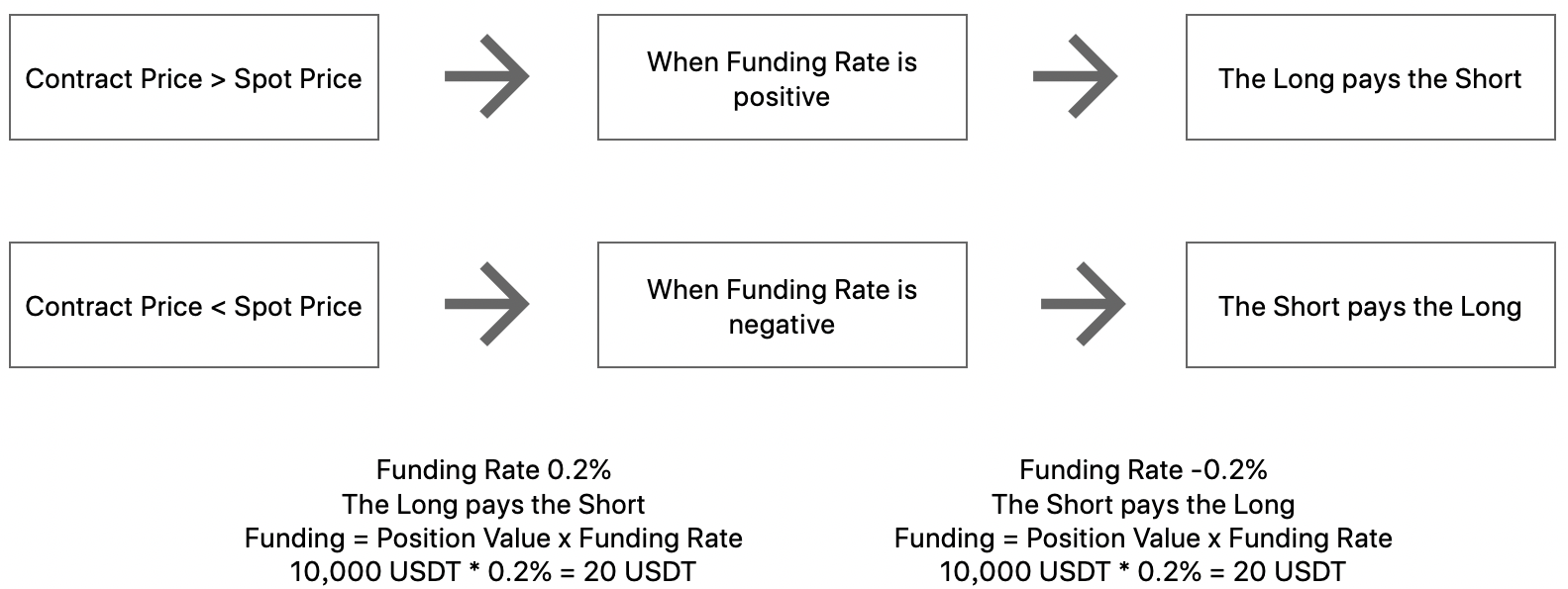

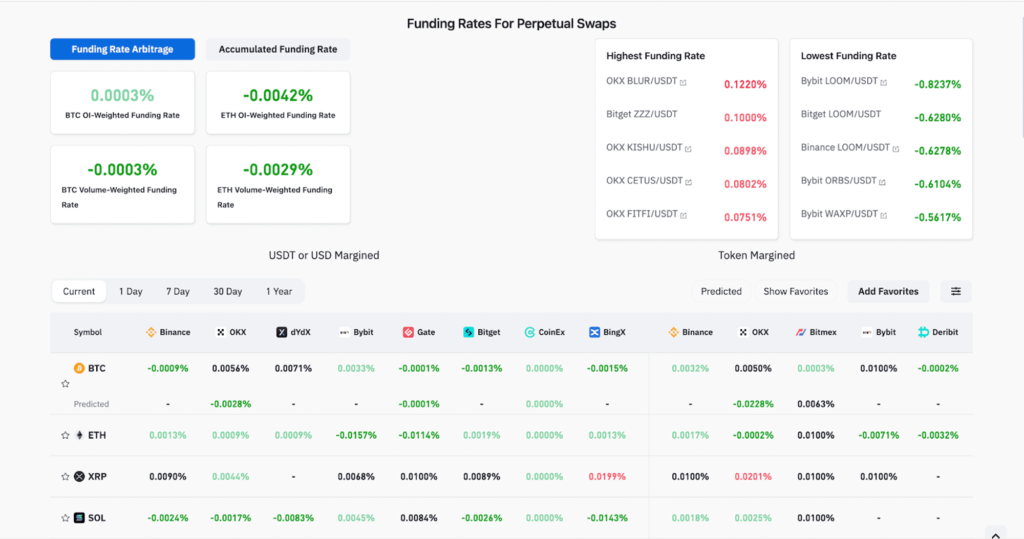

A crypto classic. Funding rates differ between exchanges. You can earn a high funding rate on one exchange and pay a lower funding rate on another exchange.

Caveats: Execution costs (spread, fees) may eat up your profits. Funding rates are never static and change every second. Exiting a no longer profitable position carries significant costs.

Bonus: Arbitrage between funding rates on perp options. The perp option box spread is an example of this. Funding rates on perp options are generally much higher than on perp futures (many perp options have funding rates as high as 10% per hour).

Spot futures arbitrage

Yet another classic strategy. Popularized by Arthur Hayes (Bitmex co-founder) in 2017. Also known as cash and carry arbitrage.

You take advantage of a high premium (or funding rate) on a futures contract and sell it, while holding an equivalent spot position in its underlying asset.

This pockets you the full premium (or funding rate) if you can hold the contract until expiration (or until the next funding exchange).

Works with both classic dated futures and perpetuals. Using it on perpetuals is usually more lucrative, since the annualized funding rate is often higher than the annualized premium.

Risks include not holding sufficient capital on the exchange (and getting liquidated) and the exchange shutting down/rugpulling (counterparty risk).

Is especially lucrative at peak mania (such as during the height of bull runs), where funding rates on major coins such as BTC can easily reach 0.3% per day on average (which translates to 298% annualized when compounded daily). Rumored to be a key contributor to the yield generation of several now defunct crypto lending platforms such as Celsius and Blockfi.

Mark price arbitrage

This one capitalizes on the poor technical implementation of many exchange API's/matching engines.

Exchanges typically calculate a Mark Price (an artificial price which is used to determine whether a position should be liquidated or not) and stream it to users every 100 milliseconds.

The formula for the Mark Price is usually public (the exchange will publish it in their docs) - meaning that you can calculate it yourself, at any time. Calculating it typically takes less than a millisecond on modern hardware.

The arbitrage relies on you calculating it faster than other market participants (some of whom may not even calculate it themselves but just rely on 100ms exchange updates). Doing this you can predict the next Mark Price, and adjust your market view accordingly.

For best results, combine it with a market making or scalping algorithm that can benefit directly from this kind of alpha.

Cross exchange (triangular) arbitrage

Simple arbitrage between exchanges. Is generally quite saturated, although there can still be opportunities on smaller exchanges and markets, especially with the triangular kind.

Very latency/execution sensitive. Latency to exchange servers and market microstructure (fees, spread) matter a lot. Since exchange servers are almost always cloud-based, things such as co-location do not matter for speed. The only things that matter is the efficiency of your code, network optimization and being in the right datacenter relative to the exchange.

The more volume you can push through your arbitrage system, the better (since you'll have access to better fee tiers on the exchanges that you are trading on). Unless you are pushing big volumes (billions per month) or trading on zero fee exchanges, expect to dedicate at least half of your monthly profits to exchange fees.

Open source bots such as Hummingbot automate part of this strategy.

Liquidation arbitrage

Some exchanges liquidate positions very aggressively, using market (or IOC limit orders) with significant market impact.

Trading into these orders can sometimes be a +EV strategy.

The orders submitted by the exchange during a liquidation event are essentially forced trading - the exchange's risk/liquidation engine needs to liquidate a user position which went bankrupt, and usually does so immediately, since the exchange is not in the business of holding inventory or taking directional bets. Forced trading is generally uninformed and unprofitable - good news for you if you can spot it in advance and trade against it.

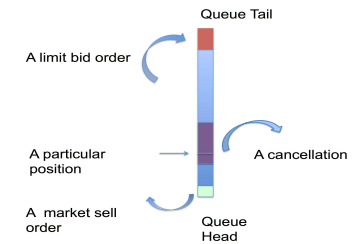

0+

Latency sensitive strategy that involves being one of the fastest participants in a specific set of markets.

Uses speed to obtain favorable positions in the order book queue and get more +EV fills than -EV fills.

Can be combined with other strategies mentioned here, such as cross exchange (triangular) arbitrage, funding rate arbitrage and liquidation arbitrage.

Being the fastest in large and popular markets is generally quite hard (if not impossible) for a retail quant, but being the fastest in a small market is very possible. Big players generally don't enter a market unless its volume is at least $10M/day. However, even a $2M/day market may yield decent enough profits for a hobby quant, if he can make a 2 bps profit on volume traded (not uncommon for strategies such as 0+). Such profit margin would provide $1,000/day in profits for the quant - not bad, depending on the capital required to run the strategy.

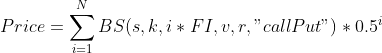

Options pricing arbitrage

The crypto options space is still very nascent and inefficient (options make up less than 10% of derivatives trading volume in crypto, whereas they make up 50% of derivatives trading volume in TradFi).

There are opportunities for retail quants who can come up with efficient pricing algorithms, especially on lesser known options venues and on exotics (perpetual options, basket options etc.). Exotics are interesting from a quant perspective, since pricing is generally not well understood yet (especially for newer exotics such as perpetual options). Many great quant firms (such as Hull Trading) have become juggernauts due to superior options pricing models employed by their founders and early employees.

Options trading in crypto can be costly because of high fees (many venues charge up to 12.5% of your notional trade value in fees). Therefore, it may be necessary to select a zero fee options exchange.

Combining strategies

It's entirely possible to combine multiple of the strategies listed here. For example, you may want to run a 0+ HFT algorithm, which operates on several exchanges (cross exchange arbitrage) and also engages in funding rate arbitrage or liquidation arbitrage. Creativity, time and coding proficiency are the only real limits here.

Here's a short summary of the strategies covered in this article:

The table above is not exhaustive - there are hundreds of unique arbitrage strategies available to retail quants - in future articles, we'll cover some more of them.